The House GOP tax plan, which Trump wanted to name the "Cut, Cut, Cut" bill, was intended to cut taxes, but it's also cutting credits, like the federal $7,500 electric vehicle tax credit. How much would its elimination affect EV sales?

So much for the "Cut, Cut, Cut" bill. It's actual name, the “Tax Cuts and Jobs Act," is also misleading in that it also caps mortgage interest and property tax deductions, which affects the homebuilding industry.

How much the elimination of the Federal Plug-In Electric Drive Vehicle Credit, an Obama-era tax incentive to spur sales of electric vehicles (EVs), would affect the still-nascent EV industry may be a matter of conjecture, but an example from Georgia two years ago is foreboding.

Thanks in great part to the nation's largest state rebate of $5,000 for EV purchases or leases, the Atlanta region ranked "highest in market share for plug-in electric vehicles," reported Andria Simmons of The Atlanta Journal-Constitution in April 2015. After Gov. Nathan Deal (R-Ga.) signed HB 170 in May, which not only ended the rebate but slapped battery-electric vehicles (but not plug-in hybrids) with the nation's highest annual EV registration fee of $200, sales plummeted.

"The market dropped like a rock,” said Don Francis, coordinator of Clean Cities Georgia, in a January 2016 post on Planetizen. "New registrations of electric vehicles have fallen by about 90 percent since the summer of 2015."

Fast forward to current proposal to scrap the federal EV tax credit.

"Advocates have ramped up lobbying efforts to save the credit, which has benefited electric vehicle manufacturers like Tesla," reports Devin Henry for The Hill on Nov. 2. "The credit is limited at the first 200,000 electric vehicles sold by each manufacturer, but no one has yet hit that cap."

“Electrification for vehicles is extremely important for the future of the auto industry, particularly given the fact that as we move towards autonomous, self-driving vehicles, those vehicles will be powered by electric,” said Sen. Gary Peters (D-Mich.), who represents America's automobile manufacturing hub, on Wednesday.

“That tax credit is really important for moving this technology forward.”

The prognosis was more dire in a report in Bloomberg News on Thursday:

“That will stop any electric vehicle market in the U.S., apart from sales of the highly expensive Tesla Model S,” said Xavier Mosquet, senior partner at consultant Boston Consulting Group, who authored a study on the growth of battery powered vehicles. “There’s no Tesla 3, no Bolt, no Leaf in a market without incentives.”

A post on Vetr Blog, a stock-watch website, observed Thursday, "Tesla's Having The Worst Day Ever As GOP Tax Plan Calls For Axing Electric Car Credit."

Another good read on the loss of the credit and what it means to EV manufacturers is by Bill Vlasic in The New York Times on Nov. 2. However, he notes that even with the the federal and state credits and other perks, "sales of electrified vehicles remain a tiny fraction of the overall market."

EVs would not be the only clean energy industry sector that would take a hit under the GOP tax plan, adds Henry for The Hill.

It would repeal an inflation increase for renewable energy production tax credits, a move that would increase taxes for power sources like wind, solar, biomass, geothermal, hydropower and others.

Will tax plan affect your commuter benefits?

If you use commuter checks to buy your transit passes or tickets or claim parking expenses as a pre-tax benefit, there is one change to note, but thanks to the below-mentioned GOP Congress members, you'll still be able to enjoy benefits, assuming your employer continues to offer them. That's the catch, as that's what that one change may impact. POLITICO's Tanya Snyder explains on Nov. 3 in Morning Transportation:

While employers would still be allowed to either give employees untaxed transportation money as a fringe benefit or to deduct it as pre-tax income from their paychecks, the businesses themselves would not be able to write off the expense.

The cap for the transit and parking subsidies (or pre-tax contributions) would still each be $260 per month for 2018. Several well-positioned urban Republicans, including Reps. Pete King of New York, Barbara Comstock of Virginia and Mike Bishop of Michigan, worked hard to keep the benefit.

Hat tip to Len Conly.

FULL STORY: GOP tax bill ends electric vehicle tax credit, overhauls other energy taxes

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

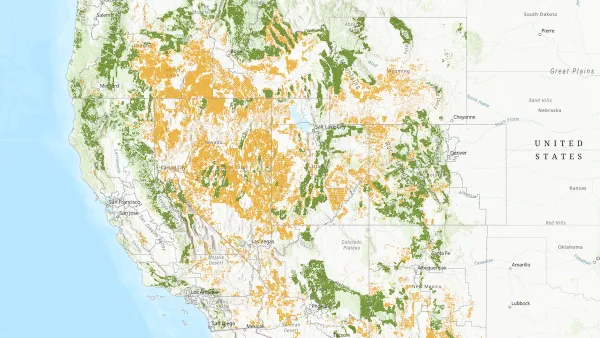

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

Platform Pilsner: Vancouver Transit Agency Releases... a Beer?

TransLink will receive a portion of every sale of the four-pack.

Toronto Weighs Cheaper Transit, Parking Hikes for Major Events

Special event rates would take effect during large festivals, sports games and concerts to ‘discourage driving, manage congestion and free up space for transit.”

Berlin to Consider Car-Free Zone Larger Than Manhattan

The area bound by the 22-mile Ringbahn would still allow 12 uses of a private automobile per year per person, and several other exemptions.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)