Tax Reform

The Surprising Oil Tax in the Inflation Reduction Act

President Biden has made reducing gas prices paramount in his administration, so it was likely a surprise to hear a Republican senator last Sunday warn TV viewers that a revived and increased oil fee in the climate bill will increase their gas costs.

Missing From the Climate-Energy Legislation: Bikes!

Missing from the Democrats' Inflation Reduction Act, the significant climate legislation which passed the Senate on a 51-50 party-line vote on Sunday with Vice President Harris casting the tie-breaking vote, is any mention of bikes.

Low-Income Housing Tax Credits Lose Luster in the Post-GOP Tax Reform World

Fewer people investing in low-income housing tax credits means fewer affordable housing units being built—at a time when affordable units are in extremely short supply.

Local Government Expect a Pinch After Texas Caps Property Taxes

Texas overhauled its property tax system with two bills in June. The debate about the consequences of that bill continues.

How Smaller Cities Are Trying to Attract Opportunity Zone Investors

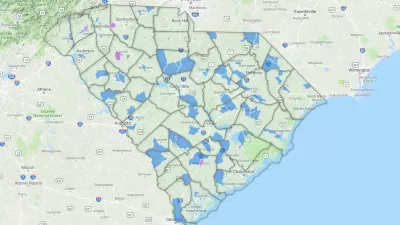

Cities and states are altering local policies to maximize benefits for private investors in Opportunity Zones.

New Property Tax Changes Proposed in California

A new bill proposed in the California legislature would cut back on the number of Prop. 13 property tax breaks handed down to heirs—who then live somewhere else.

Tax Reform and the Housing Market

Curbed analysis of how local and regional housing markets will react to changes to the country's tax code.

More Fallout on Affordable Housing from Tax Bill

While the low income housing tax credit was retained, banks will be much less willing to purchase them due to their reduced corporate tax rate. That's just one way H.R. 1 will exacerbate divisions between the rich and poor in America's cities.

Drilling in Arctic National Wildlife Refuge Allowed with Passage of GOP Tax Bill

When President Trump signs the tax-cutting bill, Sen. Lisa Murkowski (R-Alaska) will have achieved a family dream of opening up the pristine refuge, created 37 years ago, to drilling.

Home Ownership Subsidy Takes a $250,000 Hit in Final Version of Tax Bill

The current mortgage interest deduction is $1 million. The House version of the tax bill called for a $500,000 cap while the Senate left it untouched. They split the difference and capped it at $750,000. Congress is expected to pass H.R. 1 this week

What the Final Tax Reform Bill Has in Store for Housing and Development

The final version of the tax reform bill included some surprises with regard to housing and infrastructure funding mechanisms threatened in previous version of the bill.

HUD's New York Leader Suggests Privatizing Public Housing

In The Real Deal, HUD administrator Lynne Patton hints at a 10-point plan for New York and New Jersey.

Senate GOP Tax Cutters Target Bike Commuter Tax Benefit

To help pay for their massive tax cut bill, Senate Republicans have proposed elimination of a small tax benefit that can save bike commuters $240 annually. Unlike the House tax bill, they don't touch parking and transit benefits.

Editorial: Congress Should Extend, Not End, Tax Exempt Bonds for Affordable Housing

The Seattle Times says there could be no worse time than right now to repeal tax exempt bonds that help finance affordable housing.

Private Equity, Debt, and the Real Causes of the 'Retail Apocalypse'

David Duyen identifies an under-reported culprit in the so-called "retail apocalypse," and challenges policy makers to respond.

GOP Tax Plan Eliminates Critical Infrastructure-Funding Bond Program

The Tax Cut and Jobs Act would have a deleterious effect on major infrastructure proposed by the private sector. The loss of Private Activity Bonds would hike borrowing rates for road, transit, stadium, and even affordable housing projects.

House Tax Reform Bill Would Devastate Affordable Housing

The House tax reform bill threats to drastically reduce the number of affordable housing units developed.

Electric Vehicle Sales Would Take a Hit With GOP's Tax Cut

The House GOP tax plan, which Trump wanted to name the "Cut, Cut, Cut" bill, was intended to cut taxes, but it's also cutting credits, like the federal $7,500 electric vehicle tax credit. How much would its elimination affect EV sales?

Caps on Mortgage Interest, Property Tax Deductions Included in Republican Tax Reform Package

The mortgage interest deduction would be capped, as would property tax deductions, under a sweeping tax reform package proposed today by Republicans.

Home Builders Oppose Changes to Property Tax, Mortgage Interest Deductions

The National Association of Home Builders has decided that the Republican tax reform proposal would lower property values.

Pagination

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

planning NEXT

Appalachian Highlands Housing Partners

Mpact (founded as Rail~Volution)

City of Camden Redevelopment Agency

City of Astoria

City of Portland

City of Laramie