While the low income housing tax credit was retained, banks will be much less willing to purchase them due to their reduced corporate tax rate. That's just one way H.R. 1 will exacerbate divisions between the rich and poor in America's cities.

In her Big City column in The New York Times on Dec. 22, Ginia Bellafante focuses on how H.R. 1: Tax Cuts and Jobs Act, signed by President Trump the same day, will increase social inequality, particularly in cities. With tax cuts concentrated for the wealthy and corporations at the expense of adding $1.5 trillion to the national debt over ten years, the Republican controlled Congress will "push further measures of austerity — to provide the excuse to reduce federal funding for social programs on which cities rely," she writes.

While Bellafante's focus is on New York City, the points she and the experts make apply to most urban centers.

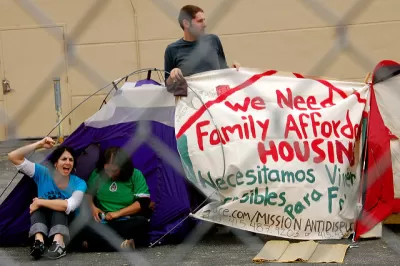

One impact will be on the construction of affordable housing due to the corporate tax reduction to 21 percent and how it impacts use of low-income housing tax credits.

Bellafante looks beyond the fact that this important tax credit, along with other important tax credits noted in a recent post based on an American Planning Association analysis, including the New Markets Tax Credit, a modified Historic Tax Credit, and tax-exempt private activity bonds, were retained in H.R.1.

Through the national Community Re-Investment Act, passed in the 1970s to address discrimination in lending, any bank receiving federal insurance must make sure it offers credit to a broad span of communities. To comply, banks became the largest purchaser of low-income housing tax credits in New York City. These credits are the instrument through which affordable housing is largely paid for.

But the reduction of the corporate tax rate to 21 percent means that there is now less of an incentive for banks to reduce their tax liability using these credits. They’ll still invest, but they’ll invest less money — in fact, this has already been happening in anticipation of the lowered corporate tax rate.

“It’s nothing short of chaos,’’ said Aaron Koffman, principal at Hudson Companies, a major developer of affordable housing in New York.

One area where the bill's impact will be less than some expect will be to act as an incentive for leaving New York City. See: "What the Tax Plan Means for New Yorkers" [pdf].

Studies that have examined the flight question have concluded that people don’t typically move from one state to another simply to avoid certain taxes.

However, the impact could be greater in the suburbs due to the new limit of deducting $10,000 in state and local taxes and property taxes.

In New York City, property tax bills that exceed $10,000 make up only 22.7 percent of households; on Long Island the figure climbs to 46.5 percent.

Education is the final urban issue the column looks at, specifically the new federal exemption of up to $10,000 each year for private-school tuition that is projected to reduce as much as $3 billion to New York's income tax base.

FULL STORY: Life, Death and Taxes in Inequality City

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Chicago’s Ghost Rails

Just beneath the surface of the modern city lie the remnants of its expansive early 20th-century streetcar system.

San Antonio and Austin are Fusing Into one Massive Megaregion

The region spanning the two central Texas cities is growing fast, posing challenges for local infrastructure and water supplies.

Since Zion's Shuttles Went Electric “The Smog is Gone”

Visitors to Zion National Park can enjoy the canyon via the nation’s first fully electric park shuttle system.

Trump Distributing DOT Safety Funds at 1/10 Rate of Biden

Funds for Safe Streets and other transportation safety and equity programs are being held up by administrative reviews and conflicts with the Trump administration’s priorities.

German Cities Subsidize Taxis for Women Amid Wave of Violence

Free or low-cost taxi rides can help women navigate cities more safely, but critics say the programs don't address the root causes of violence against women.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

planning NEXT

Appalachian Highlands Housing Partners

Mpact (founded as Rail~Volution)

City of Camden Redevelopment Agency

City of Astoria

City of Portland

City of Laramie