President Biden has made reducing gas prices paramount in his administration, so it was likely a surprise to hear a Republican senator last Sunday warn TV viewers that a revived and increased oil fee in the climate bill will increase their gas costs.

House Democrats passed the Inflation Reduction Act (H.R.5376) on Friday, August 12 on a strictly party line vote, 220-207. As posted earlier, Senate Democrats had passed the landmark climate-energy-healthcare-tax reform legislation using the reconciliation process, allowing for a strictly party-line vote of 51-50, on Sunday, August 7.

It now goes to President Biden to sign as one of the most significant legislative accomplishments of his administration, capping his “best week ever.”

“[T]he bill spends about $437 billion on climate, health subsidies and drought relief while raising about $740 billion in revenue over ten years,” reported Erik Wasson on Aug. 12 for Bloomberg News.

The non-partisan Congressional Budget Office estimated an earlier version of the bill cuts deficits over ten years by $102 billion, a figure that rises to $300 billion when revenue from expanded tax audits is factored in.

Independent studies project the bill would have a limited impact on inflation despite the name Democrats gave it. A new Penn Wharton study of the bill found that it would reduce inflation by 0.1 percentage points after five years and have no impact after 2028. In the near term, effects would have upward pressure on inflation but be “too small” to be measured by the government.

Oil fee

“There's a 16.4 percent tax on imported barrels of oil that are going to increase cost at the gas pump,” warned Sen. Lindsey Graham (R-S.C.) on CNN's State of the Union on Sunday, Aug. 7.

That assertion came as a surprise to this correspondent. The two main taxes in the Inflation Reduction Act of 2022 are:

- The 15 percent corporate minimum tax for companies earning over $1 billion annually, “originally projected to raise $313 billion in tax revenue over a decade,” according to The New York Times on August 6.

- A 1 percent excise tax on stock buybacks estimated to bring in “[J]ust over $70 billion over 10 years, according to Senate Majority Leader Chuck Schumer (D., N.Y.), who hammered out the legislation with Sen. Joe Manchin (D., W.Va.),” reported The Wall Street Journal on August 9.

Ari Natter, an energy and environment reporter for Bloomberg News, confirmed Graham's assertion in the source article published August 1.

Democrats’ plan to reinstate a 27-year-old fee on oil imports represents a violation of a pledge by President Joe Biden not to raise taxes on anyone making less than $400,000 per year, according to the conservative Americans for Tax Reform.

The Superfund tax would be used to help pay for the clean-up of hazardous waste sites. The levy, which previously stood at 9.7 cents per barrel until it lapsed at the end of 1995, would be indexed to inflation under the plan announced last week by Senate Majority Leader Chuck Schumer and Senator Joe Manchin.

Contrast with bipartisan infrastructure framework

Seeing that the revived fee, which had been introduced in 1980, would be indexed (in addition to increased – see below) to inflation made this correspondent reflect on a similar measure included in the bipartisan infrastructure deal that was the basis for the Infrastructure Investment and Jobs Act signed by President Biden on November 15.

Unlike the Manchin-Schumer deal that increases the lapsed oil fee by 69 percent (noted in the next section), the infrastructure framework did not increase the gas tax. Rather, it indexed to inflation the existing 18.4 cents-per gallon federal gas tax, unchanged for nearly three decades, but that proved too much for Biden who demanded that it be removed.

[See related post: The Big Taboo of the Senate's Bipartisan Infrastructure Proposal, June 17, 2021]

Polluter pays

“The fee would be paid by US refineries receiving crude oil and importers of petroleum products, according to the Congressional Research Service, which said proponents of the taxes believe they reflect a 'polluter pays' mentality” reported Natter of Bloomberg News on July 31.

A similar proposal, included in the Build Back Better Act that has already been passed by the House of Representatives, would have raised nearly $12 billion, according to a congressional estimate.

According to the August 10 Congressional Research Service publication, “Tax Provisions in the Inflation Reduction Act of 2022 (H.R. 5376)” [pdf], the oil fee would apply to both domestic and imported crude oil, as noted in Part 6—Superfund Reinstatement of Superfund, Section 13601 [pg. 20 / 37]:

This provision would permanently reinstate Superfund excise taxes on domestic crude oil and imported petroleum products at the rate of 16.4 cents per barrel in 2023, with adjustments for inflation annually thereafter. The previous tax rate was 9.7 cents per barrel when this tax last expired at the end of 1995.

Oil fee applies to domestic crude oil

Indeed, the reinstated oil fee is not confined to imported oil as Graham had told CNN. A 'summary' published by Congress.gov for H.R.5376 [Passed Senate (08/07/2022)] under Subtitle D--Energy Security indicates:

The bill permanently reinstates the Hazardous Substance Superfund financing rate for certain excise taxes, including the excise tax on domestic crude oil and imported petroleum products at the rate of 16.4 cents per barrel in 2023, adjusted annually for inflation.

Falling gas prices

Presumably President Biden will overlook the revived oil fee considering that gas prices have dropped steadily since peaking at just over $5.00 per gallon on June 13. The media went haywire on August 11 reporting that the national average dropped below $4.00 per gallon “for the first time in 5 months.”

Past posts on the Inflation Reduction Act:

- Missing From the Climate-Energy Legislation: Bikes! August 9, 2022 -

- 'Inflation Reduction Act' a Mixed Bag for Climate Action, Planning Innovation, August 1, 2022

Related posts on gas taxes and oil fees.

- Biden Proposes Gas Tax Holiday to Reduce Gas Prices, June 30, 2022

- The Big Taboo of the Senate's Bipartisan Infrastructure Proposal, June 17, 2021

- Biden Administration Rules Out Gas Tax Hike, February 1, 2021

- Oil Spill Liability Trust Fund Reenacted, February 19, 2018 [Per-barrel fee applied to both imported and domestic oil]

- Obama's Bold Transportation Funding Proposal Likely to Go Nowhere, February 5, 2016: President Obama, long opposed to increasing the gas tax, has proposed a $10-per-barrel oil fee to be paid by energy companies.

FULL STORY: Democrats’ Oil Import Tax Would Violate Biden Pledge, Conservative Group Says

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

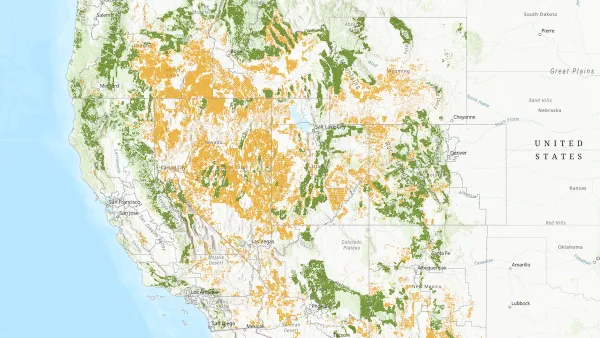

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

Platform Pilsner: Vancouver Transit Agency Releases... a Beer?

TransLink will receive a portion of every sale of the four-pack.

Toronto Weighs Cheaper Transit, Parking Hikes for Major Events

Special event rates would take effect during large festivals, sports games and concerts to ‘discourage driving, manage congestion and free up space for transit.”

Berlin to Consider Car-Free Zone Larger Than Manhattan

The area bound by the 22-mile Ringbahn would still allow 12 uses of a private automobile per year per person, and several other exemptions.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)