The News & Observer's "road worrier" (not a typo!), Bruce Siceloff, provides ongoing coverage of the sad saga of North Carolina's gas tax, set to be adjusted downwards by statute.

Planetizen has covered this issue before—decreasing oil prices affect gas tax revenue where states use wholesale oil or gasoline taxes, as opposed to excise, or per-gallon taxes. In North Carolina, Siceloff writes that the required adjustments are based on "a statutory formula that makes the tax rise and fall with the ups and downs of wholesale fuel prices – which have plunged in the past six months." It is very similar to the Kentucky case discussed here in January.

The adjustment is somewhat similar to the six-cents gas tax decrease due to take effect in California on July 1 due to a February vote by the Board of Equalization that is required to annually adjust gas taxes as explained last month.

Siceloff begins his piece with a traveler who enjoys filling up in South Carolina rather than the Tar Heel State because of their lower gas prices resulting in part from a 21-cents lower gas tax. Lower gas prices in neighboring states led New York State Sen. Jim Seward to propose a gas tax reduction. Some legislators want to 'cap' future increases or replace the gas tax with a $201 annual fee.

South Carolina's 16.75-cents gas tax is the nation's third lowest [see (PDF) based on API]. North Carolina's 37.75-cents gas tax is the sixth highest.

How bad is the decrease the North Carolina DOT is looking at?

NCDOT warns of "a precipitous drop in the gas tax rate later this year, which would cut a few hundred million dollars from the state Department of Transportation budget," writes Siceloff. However, even if the gas tax wasn't adjusted downwards, there would still be a problem due to the basic unsustainability of a (stagnant) gas tax, resulting in a projected loss of almost 50% by 2028:

Gas and diesel fuel consumption are expected to decline even as North Carolina adds an expected 3.5 million residents over the next 25 years. Federal automobile fuel efficiency standards will rise from 27.5 miles per gallon in 2010 to 51.3 mpg in 2025. As a result, DOT planners say, fuel tax collections could fall below $1 billion a year after 2028 – down from $1.9 billion this year.

Solutions proposed or considered

Most immediate is legislation to prevent the gas tax from slipping below 35 or 36-cents per gallon. A bill passed the House on March 4 to prevent the tax from slipping below 36-cents per gallon, wrote Siceloff then. "The Senate approved a more complicated package that would cut the tax to 35 cents for the rest of 2015, then make changes in the statutory formula to push the tax rate a projected 5 to 7 cents higher in future years than would be expected under current law."

Siceloff goes on to write about other revenue options, such as mileage-based-user fees (mentioned here last year), higher vehicle sales taxes, and "(h)eavy truck fees: The federal government and several states tax heavy trucks by weight and annual mileage. In Oregon, this weight-mile tax generates $300 million a year." In Oregon, there is a "requirement that trucks with a combined weight over 26,000 pounds must pay a weight-mile tax for road use in Oregon," according to ODOT.

See Iowa's "Summary of State Use of Weight-Distance Tax (in U.S.)", including "Status of Electric Vehicle Registration Fee Proposals", dated 6/24/11 [PDF].

"Even South Carolina is looking to end its cheap-gas status, with competing proposals to raise a tax that has not changed in 25 years," writes Siceloff. "Gov. Nikki Haley wants to levy an extra 10 cents on every gallon, to bring South Carolina’s gas tax even with Georgia’s."

Hat tip to Pat Carstensen of Sierra Club Chapter Transportation Chairs Listserv.

FULL STORY: North Carolina reconsiders its reliance on the gas tax

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

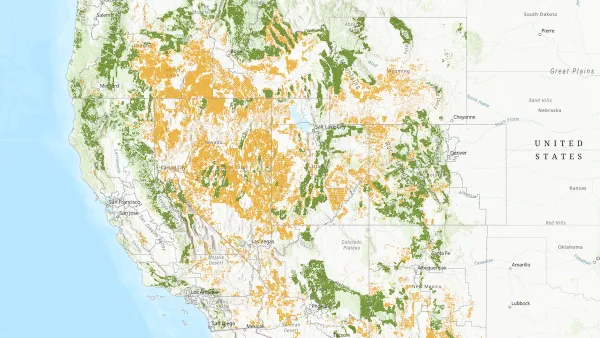

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

California Homeless Arrests, Citations Spike After Ruling

An investigation reveals that anti-homeless actions increased up to 500% after Grants Pass v. Johnson — even in cities claiming no policy change.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)