What's the best way to ensure that electric vehicle drivers pay to maintain the roads they drive on, considering they don't pay fuel taxes? A new report from the UC Davis Institute of Transportation Studies was sent to the California legislature.

With the rejection of Proposition 6 in California last November, a new "Road Improvement Fee" for zero-emission motor vehicle model year 2020 and later will take effect July 1, 2020. The $100 annual registration fee, to be adjusted for inflation, will apply to any "motor vehicle that is able to operate on any fuel other than gasoline or diesel fuel," per the Road Repair and Accountability Act of 2017 (aka Senate Bill 1).

Revenues will be deposited into the Road Maintenance and Rehabilitation Account, thus ensuring that drivers who pay little or no fuel taxes will be paying to maintain the roads and bridges they drive on. But is that the best way to ensure electric vehicles pay "their fair share" of road maintenance?

Alan Jenn, a UC Davis research scientist with the Plug-In Hybrid & Electric Vehicle Research Center, doesn't think so, calling it neither effective nor sustainable in a new report requested by the California Legislature, writes Stephen Kulieke.

“The California zero-emissions vehicle registration fee doesn’t support the long-run funding of transportation infrastructure, nor is it equitable for drivers of electric and hydrogen vehicles,” said Jenn.

“California now has the opportunity to support alternative funding mechanisms,” Jenn said. “Our study finds that a per-mile road charge, designed specifically for zero-emission vehicles [ZEVs], is a relatively low-cost and sustainable solution to funding our roads.”

In March 2017, the California State Transportation Agency completed a 9-month pilot program of a road usage charge, similar to the Oregon program in operation since July 2015. However, Jenn is proposing that the California road charge apply only to ZEVs. Gasoline and diesel-powered vehicles would continue to pay 55.53 cents-per-gallon and 87.35 cents-per-gallon taxes, respectively, per API, now adjusted for inflation thanks to SB 1.

"Electric and hydrogen vehicles should be the only ones subject to the charge, Jenn said, since they come with advanced diagnostic software already built in, meaning a mileage-tracker can more easily log miles and send that information to whoever charges the tax," reports David Iaconangelo for E&E News (subscription).

The issue transcends the Golden State. According to the National Conference of State Legislatures, as of last summer, 19 states have enacted electric vehicle registration fees to ensure these vehicles pay for road upkeep, with many applying the fee to conventional hybrid vehicles as well.

Hat tip to Streetsblog California.

FULL STORY: How to Fund Roads and Ensure Electric Vehicles Pay Their Share

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

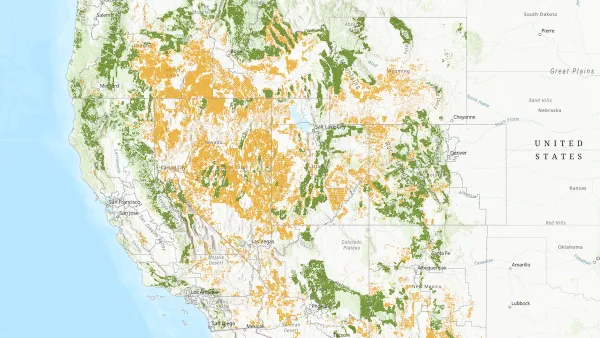

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

California Homeless Arrests, Citations Spike After Ruling

An investigation reveals that anti-homeless actions increased up to 500% after Grants Pass v. Johnson — even in cities claiming no policy change.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)