For Michael A. Pagano, local municipalities went awry in designing fiscal systems during the 20th century by fabricating what he refers to as “a crazy quilt of local revenue.” He proposes some possibilities for getting cities back on track.

From Boston to Cincinnati to Tulsa, cities depend to largely varying degrees on property taxes, income taxes, and sales taxes as a source of revenue. Historically, however, Pagano points out, “[i]t wasn't always like this." Municipal governments used to rely more heavily on property taxes and on taxing the rich. Since the turn of the 20th century, states went from raising 45 percent of their own-source revenue from the property tax, to only 3 percent in the post-World War II era, despite such taxes remaining "a dominant revenue source for decades to come."

No matter what the tax source, however, the past five years have had a huge impact on municipal revenues. “The Great Recession is just the latest challenge to cities’ ability to raise tax revenues from various sources,” writes Pagano. “Increased unemployment, declining consumer confidence and other economic trends associated with the Great Recession have had a substantial impact on all sources of tax revenue for the nation’s cities.” Yet as cities seek out new ways of raising revenues in the form of user fees, while also looking to cut spending, Pagano asks, “Is the current fiscal architecture of a city a good one?” One major problem he points to is the “free rider” economic structure of many regions in which employment centers fail to capture tax revenues from commuters despite the provision of city services “during their 9-to-5 lives.”

So, what is the solution? Pagano proposes taxation “at the place of employment” as a means of better “[linking] cities to their underlying engines of growth or to income and wealth, similar in design to what the property tax attempted to accomplish two centuries ago.” He pushes the reader to “imagine” how this could change the “decision calculus” by which individuals, households and users of city-government services choose where to work and live, while “paying their fare share.” Pagano concludes, “It could be revolutionary.”

FULL STORY: How Our Current Tax System Is Failing Cities

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

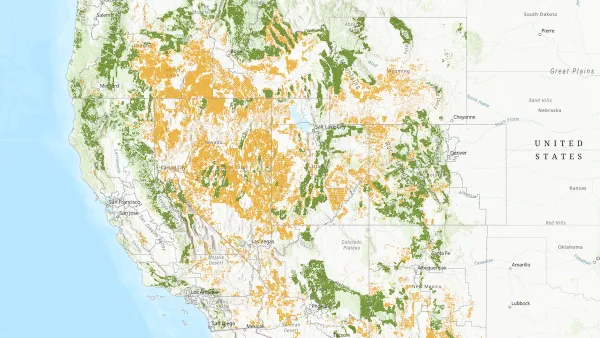

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

Platform Pilsner: Vancouver Transit Agency Releases... a Beer?

TransLink will receive a portion of every sale of the four-pack.

Toronto Weighs Cheaper Transit, Parking Hikes for Major Events

Special event rates would take effect during large festivals, sports games and concerts to ‘discourage driving, manage congestion and free up space for transit.”

Berlin to Consider Car-Free Zone Larger Than Manhattan

The area bound by the 22-mile Ringbahn would still allow 12 uses of a private automobile per year per person, and several other exemptions.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)