While the low income housing tax credit was retained, banks will be much less willing to purchase them due to their reduced corporate tax rate. That's just one way H.R. 1 will exacerbate divisions between the rich and poor in America's cities.

In her Big City column in The New York Times on Dec. 22, Ginia Bellafante focuses on how H.R. 1: Tax Cuts and Jobs Act, signed by President Trump the same day, will increase social inequality, particularly in cities. With tax cuts concentrated for the wealthy and corporations at the expense of adding $1.5 trillion to the national debt over ten years, the Republican controlled Congress will "push further measures of austerity — to provide the excuse to reduce federal funding for social programs on which cities rely," she writes.

While Bellafante's focus is on New York City, the points she and the experts make apply to most urban centers.

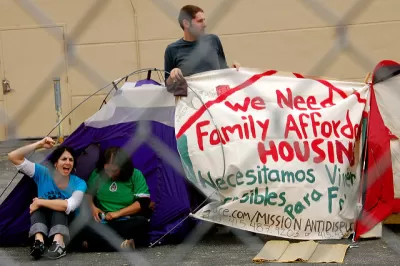

One impact will be on the construction of affordable housing due to the corporate tax reduction to 21 percent and how it impacts use of low-income housing tax credits.

Bellafante looks beyond the fact that this important tax credit, along with other important tax credits noted in a recent post based on an American Planning Association analysis, including the New Markets Tax Credit, a modified Historic Tax Credit, and tax-exempt private activity bonds, were retained in H.R.1.

Through the national Community Re-Investment Act, passed in the 1970s to address discrimination in lending, any bank receiving federal insurance must make sure it offers credit to a broad span of communities. To comply, banks became the largest purchaser of low-income housing tax credits in New York City. These credits are the instrument through which affordable housing is largely paid for.

But the reduction of the corporate tax rate to 21 percent means that there is now less of an incentive for banks to reduce their tax liability using these credits. They’ll still invest, but they’ll invest less money — in fact, this has already been happening in anticipation of the lowered corporate tax rate.

“It’s nothing short of chaos,’’ said Aaron Koffman, principal at Hudson Companies, a major developer of affordable housing in New York.

One area where the bill's impact will be less than some expect will be to act as an incentive for leaving New York City. See: "What the Tax Plan Means for New Yorkers" [pdf].

Studies that have examined the flight question have concluded that people don’t typically move from one state to another simply to avoid certain taxes.

However, the impact could be greater in the suburbs due to the new limit of deducting $10,000 in state and local taxes and property taxes.

In New York City, property tax bills that exceed $10,000 make up only 22.7 percent of households; on Long Island the figure climbs to 46.5 percent.

Education is the final urban issue the column looks at, specifically the new federal exemption of up to $10,000 each year for private-school tuition that is projected to reduce as much as $3 billion to New York's income tax base.

FULL STORY: Life, Death and Taxes in Inequality City

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

San Francisco's School District Spent $105M To Build Affordable Housing for Teachers — And That's Just the Beginning

SFUSD joins a growing list of school districts using their land holdings to address housing affordability challenges faced by their own employees.

The Tiny, Adorable $7,000 Car Turning Japan Onto EVs

The single seat Mibot charges from a regular plug as quickly as an iPad, and is about half the price of an average EV.

Seattle's Plan for Adopting Driverless Cars

Equity, safety, accessibility and affordability are front of mind as the city prepares for robotaxis and other autonomous vehicles.

As Trump Phases Out FEMA, Is It Time to Flee the Floodplains?

With less federal funding available for disaster relief efforts, the need to relocate at-risk communities is more urgent than ever.

With Protected Lanes, 460% More People Commute by Bike

For those needing more ammo, more data proving what we already knew is here.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Smith Gee Studio

City of Charlotte

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

US High Speed Rail Association

City of Camden Redevelopment Agency

Municipality of Princeton (NJ)