Federal legislation and rising sea levels are changing the way homes are insured against flooding. According to this feature article, in fact, flood insurance "is serving as a kind of advance scout into a more difficult future."

Brooke Jarvis writes an in-depth feature article that examines the changing flood insurance industry. The central trope of the article—that flooding risk has already become flooding certainty in some parts of the country—is exemplified by the Hampton Roads Area of Virginia, where the sea level is rising as the land sinks, raising relative sea levels faster than anywhere else on the Atlantic Coast. Jarvis explains of the planning relevance of this story in the city of Norfolk:

The operative measurement for rising waters in Norfolk is not inches but feet — as many as six of them by the end of the century, according to the Army Corps of Engineers, though estimates vary. City planners are forthright that they’re preparing for a future in which parts of the city do not survive.

The extreme risks facing coastal communities are visible in the insurance industry, which is changing quickly in response to the more frequent floods brought about by rising sea levels and more extreme weather events, but also federal legislation known as. Biggert-Waters and Grimm-Waters, passed in 2012 and 2014, respectively. "The first law cut subsidies and phased out grandfathered rates so that premiums would start to reflect the true risk that properties…face — reaching what the N.F.I.P. calls 'actuarial soundness.' The second tried to slow the rate of those increases when it became clear how hard they would hit property owners," writes Jarvis.

The long-read article is the second in a series from the New York Times Magazine's climate issue. The article includes a lot more detail about the insurance industry, the land use implications of sea level rise, and the effect of federal legislation on how homeowners are addressing the challenges of climate change. Consider this article mandatory reading for planners, homeowners, and residents living in coastal areas.

For more coverage of insurance in a world of certain flooding, see a feature article about a Urban Land Institute report from 2013 and an article by ARUP from March 2017.

FULL STORY: When Rising Seas Transform Risk Into Certainty

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

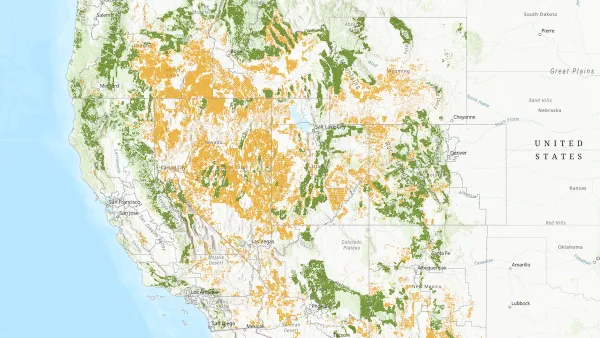

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

California Homeless Arrests, Citations Spike After Ruling

An investigation reveals that anti-homeless actions increased up to 500% after Grants Pass v. Johnson — even in cities claiming no policy change.

Albuquerque Route 66 Motels Become Affordable Housing

A $4 million city fund is incentivizing developers to breathe new life into derelict midcentury motels.

DC Area County Eliminates Bus Fares

Montgomery County joins a growing trend of making transit free.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)