One would expect the Utah Taxpayers Association to oppose county measures to increase general sales taxes by .25 percent to fund transportation programs, so their endorsement of an alternative revenue option, the mileage fee, is surprising.

Even before the five-cent gas tax increase goes into effect on January 1, counties in Utah will have the option to allow voters to increase general sales taxes by one-quarter percent in November due to a provision in the the legislation signed in March by Republican Gov. Gary Herbert.

The group makes clear they are for good roads and transit—it's the non-user fee mechanism, the sales tax "which has no direct correlation to Utah’s roads" they oppose.

Instead of trying to hide the cost of Utah’s roads in a sales tax, Utah’s lawmakers need to be innovative and forward thinking in how the state can ensure the transportation funding system is sustainable long term.

They need to consider a vehicle miles traveled (VMT) system of assessing individual road use and funding highways. This type of funding mechanism would ensure that the cost of roads is borne by the users and would prevent alternative fuel users from avoiding paying their fair share for the use of the state’s transportation system.

The group adds that "Utah is already part of a twelve state coalition [PDF] studying VMT as a way of funding highways. Your Utah Taxpayers Association encourages greater exploration into VMT by UDOT and the State Legislature."

Notwithstanding this recent endorsement of user fees, it did not prevent the group in March from blasting Gov. Herbert for signing the gas tax increase legislation.

Sales tax revenues raised on a local level would be substantial. If all counties agree to put the transportation sales tax measures on the ballot and they all pass, the revenues would be twice the amount of the additional five-cent gas tax in 2016 according to a fiscal note in HB 362, adds the taxpayers association.

What may be particularly noteworthy about the group's position, in addition to a taxpayer group endorsing a mileage fee, is that heretofore most comparisons have been between gas taxes and vehicle-miles-traveled fees, not the latter and sales taxes.

While the Utah Taxpayers Association may be the first, if not only taxpayers group to support a VMT fee, they are certainly not alone.

A July survey of transportation professionals by Politico found that respondents agreed that "(t)he gas tax, our main source of highway money since the 1950s, is probably doomed" and that "the most promising idea, to judge by the numbers, is to charge individual drivers a mileage fee."

FULL STORY: Counties Should Reject the Local Option Sales Tax for Roads

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

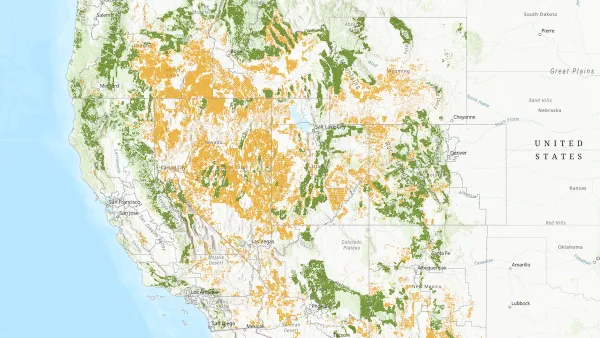

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

California Homeless Arrests, Citations Spike After Ruling

An investigation reveals that anti-homeless actions increased up to 500% after Grants Pass v. Johnson — even in cities claiming no policy change.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)