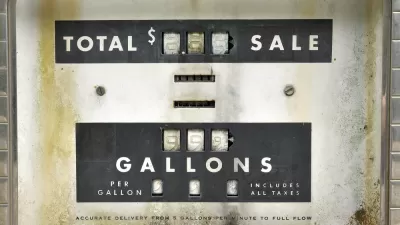

One of two initiatives to repeal last November's 12-cents per gallon gas tax increase failed to attract enough signatures by the Jan. 8 deadline. However, the other initiative has major backing and will likely appear on the Nov. 6 ballot.

Assemblyman Travis Allen (R-Huntington Beach) had hoped his "Repeal the Gas Tax" campaign would also promote his campaign for governor in this November's election. While his name will appear on the ballot, his initiative won't.

"Allen had 150 days to collect 365,000 signatures to qualify his initiative for the November ballot, but the deadline passed this week without any signatures being turned in," reports Patrick McGreevy for the Los Angeles Times on Jan. 12.

He said he will support a campaign for a similar ballot measure backed by the Howard Jarvis Taxpayers Assn. and rival GOP candidate for governor John Cox.

Allen won a significant lower court battle over the title of his initiative in October only to lose on appeal by Attorney General Xavier Becerra in November. An appeal to the state Supreme Court was denied. He blamed the court battles for the failure to qualify his initiative.

Reform California initiative

"The initiative that has received financial backing from Cox has collected 400,000 of the 580,000 signatures needed to qualify a constitutional amendment for the November ballot," adds McGreevy. "That measure would not only repeal the gas tax but require future gas tax increases to be approved by the voters."

By contrast, the Allen initiative would have been statutory law, thus had a lower signature threshold. The "California Voter Approval for Gas and Vehicle Taxes Initiative" has until June 28 to submit sufficient signatures to the Secretary of State's office.

According to a Capital Public Radio broadcast on Jan. 22 on the two ballot initiatives, San Diego businessman Cox contributed $250,000 toward the Reform California initiative.

A UC Berkeley poll taken last month found 52 percent of voters support repealing the new 12-cents per gallon gas tax and other taxes and fees in the SB 1 legislation, while 43 percent favored retaining the taxes and fees.

Road Repair and Accountability Act to pour revenues into roads and transit

"Gov. Jerry Brown proposed to spend $4.6 billion from new gas taxes and vehicle fees on repairing California’s roads and bridges and improving rail systems in the next year, and downplayed the threat that voters might repeal the levies in November," reported McGreevy on Jan. 10.

The governor’s proposed budget includes $2.8 billion of the new tax revenue to repair neighborhood roads, state highways and bridges, $556 million to improving trade and commute corridors, $200 million to match county funds on transportation projects and $721 million to improve local passenger rail and public transit system

Over $5 billion annually is projected to be generated annually from fuel taxes and vehicle fees in the Road Repair and Accountability Act of 2017, SB 1 (Beall), passed by the legislature last April. It invests $52.4 billion over the next decade - split equally between state and local investments. [See list of programs on governor's webpage].

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

Platform Pilsner: Vancouver Transit Agency Releases... a Beer?

TransLink will receive a portion of every sale of the four-pack.

Toronto Weighs Cheaper Transit, Parking Hikes for Major Events

Special event rates would take effect during large festivals, sports games and concerts to ‘discourage driving, manage congestion and free up space for transit.”

Berlin to Consider Car-Free Zone Larger Than Manhattan

The area bound by the 22-mile Ringbahn would still allow 12 uses of a private automobile per year per person, and several other exemptions.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)