Lieutenant Governor Brian Calley broke a tie vote in the state Senate on July 1 to pass a 15-cent gas tax increase over three years to raise $1.5 billion. In May, voters rejected a sales tax increase that would have triggered a gas tax increase.

Unlike the complex May ballot measure that voters overwhelmingly defeated, the two bills to amend the state Motor Fuel Act, HB 4615 and HB 4616 do not call for public votes. The legislation raises the 15-cent diesel tax to match the 19-cent per gallon gas excise tax*, last increased in 1997, hikes both to 34 cents by 2017, and indexes them to inflation.

Democrats who might have supported that gas tax increase had a problem with a different aspect of the bill, writes Kathleen Gray of the Detroit Free Press.

The Senate also passed a requirement that $350 million from income tax revenues be shifted to roads in the 2015-16 fiscal year and $700 million in 2016-17. But details weren't given on where those dollars would be shifted from and that caused most of the Democrats to withhold support from the entire package.

"I want to fix the roads as much as all of you. I'm more than willing to sit down and find a solution," said Sen. Curtis Hertel, Jr., D-East Lansing. "We can't fill potholes on the backs of working men and women."

Consequently, only one Democrat supported the bill, along with 18 Republicans, creating an even 19-19 vote that needed the lieutenant governor's vote to pass it.

Controversial language to end "the Earned Income Tax Credit that provides nearly $150 a year to working poor families" that is in the House bill was not included in the Senate version. "Now it becomes the House's turn to deal with the huge changes made by the Senate to the bills they passed earlier this month," writes Gray, who goes on to describe additional differences between the House and Senate versions of the legislation.

At 15 cents per gallon (19 for diesel), Michigan's gas tax hike would be the highest increase covered here. [Next would be Washington's 11.9 cents bill which the legislature passed on July 1]. However, the most controversial aspect of the tax hike is not its size but the transfer of $700 million annually of income tax revenue to the transportation fund, elimination of the EITC, and possible reduction of the income tax.

End Note:

*According to the American Petroleum Institute [PDF], as of April 1 Michigan had $.1406 in "other taxes/fees" in addition to the $.19 gas tax, resulting in a total of in a total gas tax of $.3306. It was the 12th highest in the country as of April 1 [PDF].

Hat tip to Tanya Snyder, StreetsblogUSA

FULL STORY: Michigan Senate passes increase in gas tax

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

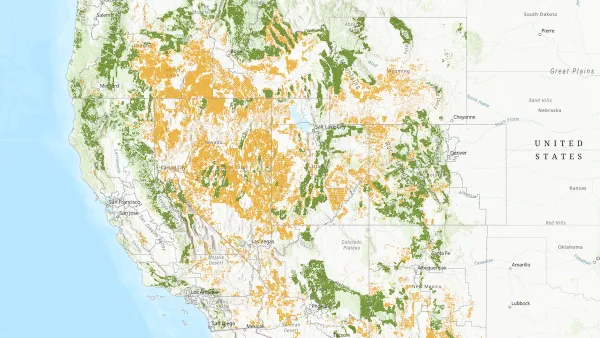

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

Platform Pilsner: Vancouver Transit Agency Releases... a Beer?

TransLink will receive a portion of every sale of the four-pack.

Toronto Weighs Cheaper Transit, Parking Hikes for Major Events

Special event rates would take effect during large festivals, sports games and concerts to ‘discourage driving, manage congestion and free up space for transit.”

Berlin to Consider Car-Free Zone Larger Than Manhattan

The area bound by the 22-mile Ringbahn would still allow 12 uses of a private automobile per year per person, and several other exemptions.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)