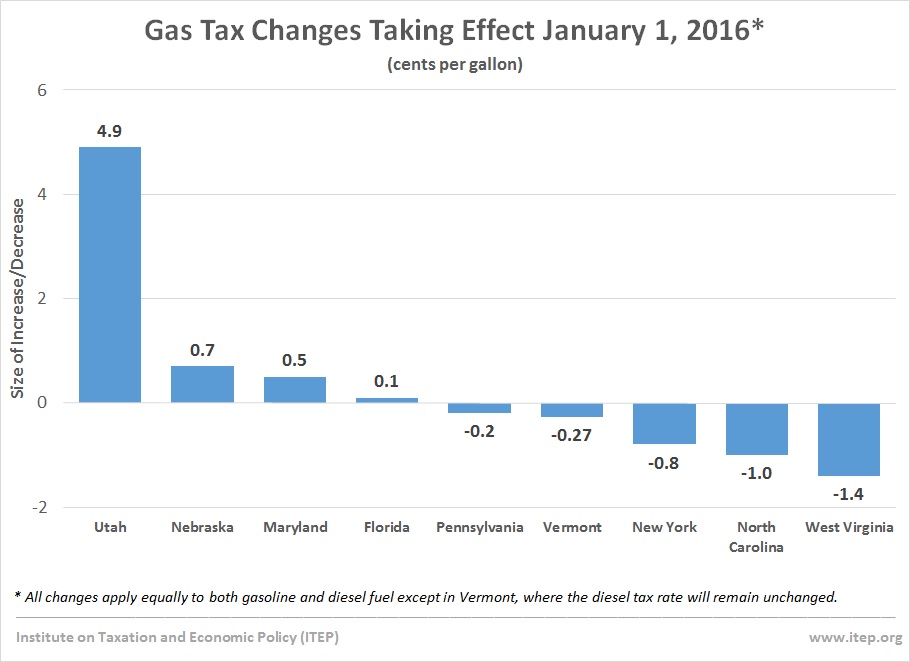

In case you were wondering if any state gas taxes, other than Utah as previously posted, changed on New Years Day—eight others did, but only slightly, due to required, automatic adjustments. Most telling was that more went down than up.

Utah's was the only gas tax that changed on New Years Day as a result of direct, hard-fought legislation, so the 4.9 cents increase was in fact an outlier. Carl Davis, Research Director of the Institute on Taxation and Economic Policy (ITEP) indicates the changes in the chart below.

"Gas tax rates will decline in New York, North Carolina, Pennsylvania, Vermont, and West Virginia—in most cases because of gas tax rate structures that link the rate to the average price of gas," writes Davis.

When gas prices fall, the variable rate may need to be adjusted downwards, as was the case in New York, North Carolina, Pennsylvania, Vermont, and West Virginia. Davis likens it to "an approach similar to a traditional sales tax applied to an item’s purchase price."

When gas prices are at a 6-year low, "falling beneath $2 a gallon for the first time since 2009," as NBC reported on Dec. 21, the downward adjustment can be problematic for states dependent on gas tax revenue to fund infrastructure projects. NBC news anchor Lestor Holt adds, "And a lot of folks are celebrating by going for a new car or truck, pushing sales to record heights," but that's another story.

With gas prices projected to remain low though 2016, it would behoove states with variable rates (and there are 19 of them) to "limit gas tax volatility by imposing 'floors' on the minimum tax rate, limitations on how much the rate can change from one year to the next," writes Davis.

(A)nd in some cases even moving toward entirely different formulas based on more stable (and arguably more relevant) measures of inflation.

For example, rather than tying the rate to the price of gas, the Consumer Price Index (CPI) or other inflation indexes can be used. Some states use vehicle fuel efficiency and population.

Different variable rate formulas account for rising gas tax increases in Florida, Maryland, Nebraska while gas prices fell. Davis goes on to describe the specific variable rate formulas in the eight states that saw gases fluctuate both up and down last year.

Hat tip to Martine Powers and Jennifer Scholtes of POLITICO Morning Transportation, Jan. 4. ("It's a gas" segment)

FULL STORY: January 1 Brings Gas Tax Changes: 5 Cuts and 4 Hikes

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

California Homeless Arrests, Citations Spike After Ruling

An investigation reveals that anti-homeless actions increased up to 500% after Grants Pass v. Johnson — even in cities claiming no policy change.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)