The half-cent sales tax will fund new rebate programs for zero and near zero-emissions vehicles and multimodal transportation. Opponents claim the privilege tax, as it is called, violates the state constitution because revenues aren't used for roads.

"A group that includes the AAA Oregon/Idaho and the Oregon Trucking Association is asking the state Supreme Court to block a portion of a pending state law they say improperly imposes what amounts to a sales tax worth up to $60 million on new car sales," reports Gary Warner for The Bulletin. The taxes and fees in the law, HB 2017, take effect on Jan. 1.

The pending state law is HB 2017, which also includes a staged, 10-cent gas tax hike and a first-of-its-kind bike tax, passed the legislature in July, and was signed by Democratic Gov. Kate Brown in August. Only the vehicle privilege tax is targeted in the lawsuit.

The petition filed Nov. 3 takes aim at a 0.5 percent “privilege” tax on dealers for every new car sold in Oregon. Under the tax, dealers can pass along the privilege tax through the final sales price of the vehicle. For example, a 2018 Subaru Outback 25i with a retail price of $24,000 would be subject to a $120 privilege tax.

The group says the tax is barred by a voter-approved 1980 law that all vehicle taxes go to a fund to build and maintain state roads and highways.

Lawmakers expected challenge

"Lawmakers were worried that the privilege tax might derail the whole legislation, so they inserted language calling for an expedited review if the tax was challenged," adds Warner. The attorney for the plaintiffs indicates that "the case will likely be heard March 24," well after the tax takes effect.

The constitutional provision in question is Article 9 which "states that 'any tax or excise levied on the ownership, operation, or use of motor vehicles' must go to pay for road construction and maintenance," reported Saul Hubbard and Sherri Buri McDonald for The Register-Guard on May 7, when the legislature was considering a one percent privilege tax. "That provision dates to 1980, when voters approved a ballot measure restricting the use of highway fund dollars."

More about the vehicle privilege tax

It got its quirky name because it's a tax "for the privilege of selling new vehicles in Oregon," so it applies to in-state dealers, according to the Oregon Department of Revenue. In addition, "Oregon residents and businesses that purchase vehicles outside of Oregon" are also subject to the sales tax.

Furthermore, it's not just passenger motor vehicles, but motor homes, trucks and truck trailers weighing under 26,000 pounds, and electric-assist bikes that are subject to the tax, explaining the involvement of the trucking association as well as the AAA in the lawsuit.

About where the revenues go

According to the Oregon Department of Environmental Quality, the upcoming Zero Emission Vehicle Rebate Program will "provide rebates to Oregonians who purchase certain types of electric vehicles (including plug-in hybrid electric vehicles) and other qualifying zero-emissions vehicles (ZEVs). This program was designed by the Oregon legislature to encourage higher adoption of ZEVs, reducing air pollution and advancing progress toward the state’s greenhouse gas reduction goals."

While the state will begin collecting funds on January 1, 2018, the amount of funds collected will not be sufficient to start granting rebates until the summer of 2018.

As posted in September, rebate revenues also fund a new "Charge Ahead Oregon Program" that establishes additional rebates up to $2,500 to low and moderate income residents who retire their high-emission vehicles and purchase new or used EVs.

The first $12 million annually of privilege tax revenue goes to the Zero-Emission Incentive Fund. Remaining funds are transferred to the Connect Oregon Fund, as are revenues from the $15 excise tax paid by those who purchase bicycles costing more $200 and with a wheel diameter of 26-inches or larger. Revenues from the bike tax are restricted to funding bicycle/pedestrian infrastructure.

Hat tip to AASHTO Daily Transportation Update.

FULL STORY: High court asked to halt car tax

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

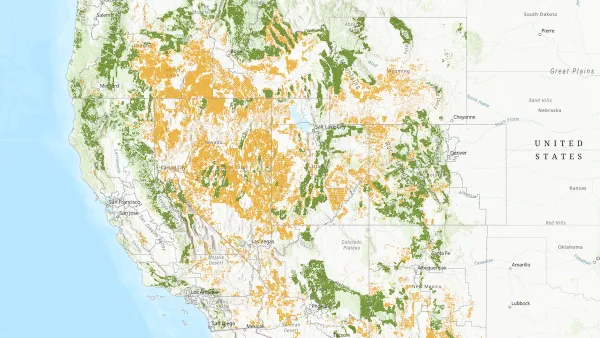

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

DC Area County Eliminates Bus Fares

Montgomery County joins a growing trend of making transit free.

Platform Pilsner: Vancouver Transit Agency Releases... a Beer?

TransLink will receive a portion of every sale of the four-pack.

Toronto Weighs Cheaper Transit, Parking Hikes for Major Events

Special event rates would take effect during large festivals, sports games and concerts to ‘discourage driving, manage congestion and free up space for transit.”

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)