The climate crisis will present more of an existential crisis to the traditional U.S. mortgage market than any previous financial crisis, according to some of the experts cited in the article.

"Up and down the coastline, rising seas and climate change are transforming a fixture of American homeownership that dates back generations: the classic 30-year mortgage."

An article by Christopher Flavelle for The New York Times documents that transformation, opening with the words quoted above. As for what that transformation looks like, Flavelle writes:

Home buyers are increasingly using mortgages that make it easier for them to stop making their monthly payments and walk away from the loan if the home floods or becomes unsellable or unlivable. More banks are getting buyers in coastal areas to make bigger down payments — often as much as 40 percent of the purchase price, up from the traditional 20 percent — a sign that lenders have awakened to climate dangers and want to put less of their own money at risk.

And in one of the clearest signs that banks are worried about global warming, they are increasingly getting these mortgages off their own books by selling them to government-backed buyers like Fannie Mae, where taxpayers would be on the hook financially if any of the loans fail.

As noted in the article, the 30-year mortgage is a U.S. social institution dating back to the Great Depression, but as the world changes, so too does the risk of long-term financial commitments. According to the article, the decline of mortgages might not only put taxpayer money at risk, it might also put homeownership out of reach of more taxpayers.

FULL STORY: Rising Seas Threaten an American Institution: The 30-Year Mortgage

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

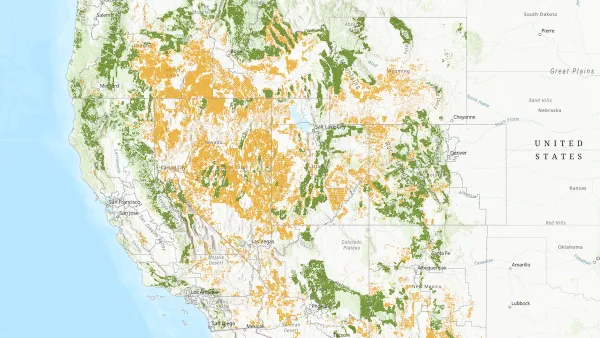

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

California Homeless Arrests, Citations Spike After Ruling

An investigation reveals that anti-homeless actions increased up to 500% after Grants Pass v. Johnson — even in cities claiming no policy change.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)