According to a new report detailing discriminatory lending in Chicago, people in majority-white neighborhoods continue to receive more loans, and in greater amounts, than people in majority-Black and majority-Latino areas.

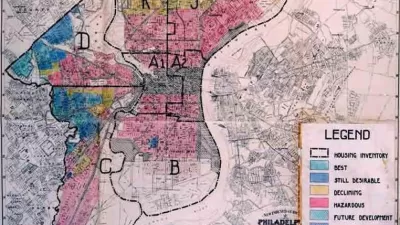

New analysis from WBEZ and City Bureau shows the massive disparity in lending to residents of white neighborhoods compared to residents of black and Latino neighborhoods in Chicago. Linda Lutton, Andrew Fan, and Alden Loury call the practice "Modern-day redlining," describing "a pattern that locks residents out of home ownership, deprives communities of desperately needed capital investment and threatens to exacerbate racial inequities between neighborhoods."

When WBEZ and nonprofit newsgroup City Bureau reviewed 168,859 home loans between 2012 and 2018 made by banks and non-bank mortgage companies, they found that of the $57.4 billion loaned, 68.1% of cash funded people in majority-white neighborhoods with only 8.1% going to majority-black neighborhoods and 8.7% ending up in majority-Latino neighborhoods. Their report notes that while higher home prices in majority-white neighborhoods can explain part of the imbalance, the fact that "financial institutions made four times more loans in Chicago’s white neighborhoods than they did in black or Latino areas" obviously points to a much larger problem.

According to the authors, injecting money into neighborhoods in the form of home loans is a fundamental way to impact the health of communities and the quality of life of its residents.

FULL STORY: Where Banks Don’t Lend

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

In California Battle of Housing vs. Environment, Housing Just Won

A new state law significantly limits the power of CEQA, an environmental review law that served as a powerful tool for blocking new development.

Boulder Eliminates Parking Minimums Citywide

Officials estimate the cost of building a single underground parking space at up to $100,000.

Orange County, Florida Adopts Largest US “Sprawl Repair” Code

The ‘Orange Code’ seeks to rectify decades of sprawl-inducing, car-oriented development.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Jefferson Parish Government

Camden Redevelopment Agency

City of Claremont