Not only might Alaskans have to pay a state income for the first time since 1980, three years after the Trans-Alaska Pipeline was completed, but Alaska Permanent Fund checks might drop 50 percent to cope with falling crude oil tax revenue.

"This is the nation’s least-taxed state, where oil royalties and energy taxes once paid for 90 percent of state functions," writes In fact, according to according to Bankrate.com, "Alaska is the only state that does not collect state sales tax or levy an individual income tax."

There wasn't a need to tax residents shortly after completion of the 800-mile Trans-Alaska Pipeline in 1977, allowing oil to flow from Prudhoe Bay and other oil fields on the North Slope to Valdez where it would be loaded on tankers for California, other West Coast ports, and even South Korea.

With every barrel of oil, the state collected a royalty and a production tax that paid for most of state government and the creation of a multibillion-dollar Permanent Fund savings account.

Every eligible Alaskan resident, children as well as adults, received a payment this year of $2,072 from the Alaska Permanent Fund Corporation. However, the size of the check is as much if not more dependent on investment revenue than oil revenue. That would change under a proposal by Gov. Bill Walker.

"Production of the oil has declined from a peak of 2.1 million barrels a day in 1988 to an average of 523,797 barrels a day this month, state data show," notes a Bloomberg article dated Oct. 21, 2014. That's a decline of 75 percent. As noted previously, the volumes in the Trans-Alaska Pipeline are so low as to endanger it's operation.

Exacerbating the decline in crude oil production has been the drop in oil prices since July, 2014, and the free fall after a November 27, 2014 OPEC meeting, the effect on state finances was bound to be dramatic: "Two-thirds of the revenue needed to cover this year’s $5.2 billion state budget cannot be collected," writes Johnson.

Mr. Walker’s recovery plan would take more from residents through the income tax and would give them less as well, by changing the formula under which the dividend is paid. The income tax would be 6 percent of the amount an Alaskan currently pays in federal taxes, so a person who owed $10,000 to the Internal Revenue Service would also need to write a $600 check to Alaska.

Dividend payments would be tied directly to royalties that decrease or increase with oil production. Because oil production is down, next year’s payout would be cut by roughly half under the proposal, to about $1,000 a person. The governor would also raise taxes on alcohol and tobacco and would collect new taxes from the fishing, mining, energy and tourism industries.

Noticeably absent is an increase to the state's gas tax, lowest in the nation at 12.25 cents per gallon [PDF], although it was increased .95 cents on July 1.

Johnson goes on to discuss the political challenges awaiting Walker, an Independent, in his proposal. Notwithstanding the outcome of a ballot measure last year where voters chose to lower taxes on energy companies in order to increase production, Walker's budget doesn't exempt them from new taxes.

The energy industry’s main lobbying group has vowed to fight Mr. Walker’s proposal to collect $100 million in new taxes on oil and gas companies, while reducing by $400 million the tax credits they can claim

The FY 2017 budget was unveiled by Gov. Walker on Dec. 15. His press release indicates that "the plan addresses the state’s $3.5 billion budget deficit using a combination of spending cuts, new revenue, wealth management and investment." The proposed budget has been reduced from the current year's operating budget of $4.8 billion, notes the release.

FULL STORY: As Oil Money Melts, Alaska Mulls First Income Tax in 35 Years

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

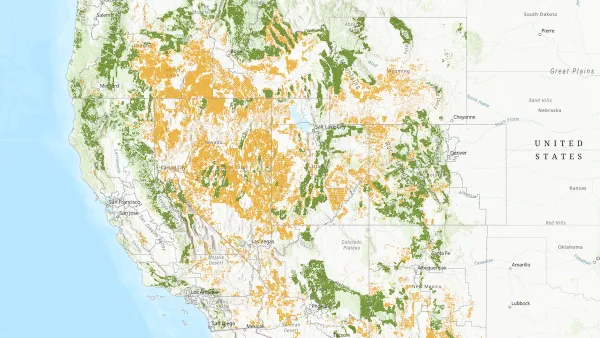

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

California Homeless Arrests, Citations Spike After Ruling

An investigation reveals that anti-homeless actions increased up to 500% after Grants Pass v. Johnson — even in cities claiming no policy change.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)