The 30% “CUB credit” would support the conversion of buildings 15 years or older into any use that “will return that vacant area to an income-producing, habitable condition.”

As the value of commercial buildings collapses in the wake of the pandemic, Minnesota city leaders want state help to convert underutilized buildings into housing or better commercial uses, according to an article by Madison McVan for the Minnesota Reformer.

Office towers that were once prime locales for blue chip tenants have been selling at massive discounts — 97 percent in one recent case — alarming city leaders who are forced to shift the tax burden to residents.

There are already state and federal tax credits for the rehabilitation or conversion of historic buildings, but developers and city leaders want a bigger state tax credit — up to 30 percent of a project’s cost, compared to 20 percent for the existing historic state credit — and to apply it to more buildings.

The bill (SF768/HF467) does not require that the buildings be converted to housing to qualify for the credit. Instead, conversions qualify if they remake a commercial building for another commercial use that the building was not originally built to accommodate, or if at least half of the building has been vacant for five years, and the conversion “will return that vacant area to an income-producing, habitable condition.”

The credit — called the “credit for conversion of underutilized buildings,” or the “CUB credit” — would apply to buildings at least 15 years old.

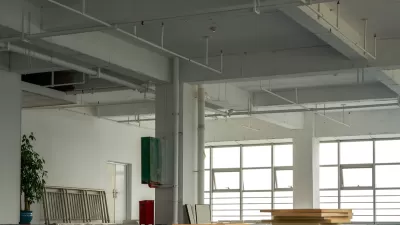

Converting office buildings to apartments is complicated.

Many office towers aren’t structurally fit for housing: Some are so large that many apartments would lack windows, a dealbreaker for prospective residents. Others have exteriors made almost entirely of glass. Plumbing is often centralized — one floor may have one or two common restrooms, while apartments require many bathrooms spread across the floor.

And while interest rates have dropped from their most recent peak in 2023, they’re still well above the rates of the 2010s and the historic lows reached during the pandemic.

Minneapolis Mayor Jacob Frey testified in support of the tax credit proposal. Commercial property values in Minneapolis have dropped by 9.5 percent over the past year, and the shrinking commercial tax base means an increased property tax burden on homeowners.

Rest, a co-author of the bill, pointed out that commercial properties are taxed at a higher rate than residential properties, so conversions could reduce the tax rate on many buildings.

A longer version of this story was originally published on Minnesota Reformer.

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Congressman Proposes Bill to Rename DC Metro “Trump Train”

The Make Autorail Great Again Act would withhold federal funding to the system until the Washington Metropolitan Area Transit Authority (WMATA), rebrands as the Washington Metropolitan Authority for Greater Access (WMAGA).

DARTSpace Platform Streamlines Dallas TOD Application Process

The Dallas transit agency hopes a shorter permitting timeline will boost transit-oriented development around rail stations.

The Tiny, Adorable $7,000 Car Turning Japan Onto EVs

The single seat Mibot charges from a regular plug in about as much time as an iPad, and is about half the price of an average EV.

Supreme Court Ruling in Pipeline Case Guts Federal Environmental Law

The decision limits the scope of a federal law that mandates extensive environmental impact reviews of energy, infrastructure, and transportation projects.

Texas State Bills to Defund Dallas Transit Die

DART would have seen a 30% service cut, $230M annual losses had the bills survived.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Roanoke Valley-Alleghany Regional Commission

City of Mt Shasta

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

US High Speed Rail Association

City of Camden Redevelopment Agency

Municipality of Princeton (NJ)