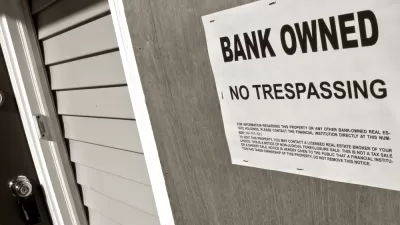

The state of California is trying to prevent a repeat of one of the most significant consequences of the Great Recession: large Wall Street interests buying for-sale housing in bulk for conversion to apartments.

Oscar Perry Abello writes to summarize the shifting status of the real estate market—from private ownership by individuals to corporate ownership by Wall Street money—and to detail efforts to control the trend in California.

For a succinct description, with the key evidence, of the scope of the trend, Abello writes:

Before 2010, corporate landlords didn’t exist in the single-family market; by March of this year, Wall Street had acquired $60 billion worth of distressed or foreclosed properties across the country, representing hundreds of thousands of homes.

Most of those properties became rentals. Between 2006 and 2012, the number of owner-occupied housing units in California declined by more than 320,000, while the number of renter-occupied housing units increased by more than 720,000, according to the Public Policy Institute of California. In 2006, only 21 percent of occupied single-family houses in California were rented; by 2012, the share of houses occupied by renters had increased to 26.0 percent.

The disruption of the COVID-19 pandemic and the resulting economic downturn are expected to exacerbate the trend, according to a widely circulated article by Ryan Dezember, published by the Wall Street Journal in September. Also widely circulated: the nascent efforts by a few politicians to add regulatory controls to slow large corporate interests from buying up all the distressed properties in the market.

Enter SB 1079, a law recently adopted by the state of California, which makes it harder for big-money investors to buy foreclose properties en masse. Exactly how the law accomplishes that goal—by preventing bulk foreclosure sales and for holding lenders responsible for the upkeep of foreclosed properties—is the focus of Abello's article.

FULL STORY: California’s New Law Gives Communities a Chance to Stop the Private Equity Housing Grab

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Congressman Proposes Bill to Rename DC Metro “Trump Train”

The Make Autorail Great Again Act would withhold federal funding to the system until the Washington Metropolitan Area Transit Authority (WMATA), rebrands as the Washington Metropolitan Authority for Greater Access (WMAGA).

The Simple Legislative Tool Transforming Vacant Downtowns

In California, Michigan and Georgia, an easy win is bringing dollars — and delight — back to city centers.

The States Losing Rural Delivery Rooms at an Alarming Pace

In some states, as few as 9% of rural hospitals still deliver babies. As a result, rising pre-term births, no adequate pre-term care and "harrowing" close calls are a growing reality.

The Small South Asian Republic Going all in on EVs

Thanks to one simple policy change less than five years ago, 65% of new cars in this Himalayan country are now electric.

DC Backpedals on Bike Lane Protection, Swaps Barriers for Paint

Citing aesthetic concerns, the city is removing the concrete barriers and flexposts that once separated Arizona Avenue cyclists from motor vehicles.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Smith Gee Studio

City of Charlotte

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

US High Speed Rail Association

City of Camden Redevelopment Agency

Municipality of Princeton (NJ)