How to keep affordable apartments and single-family homes out of the hands of institutional investors if the coronavirus pandemic leads to a giant wave of evictions and foreclosures.

When the dust had settled and the Great Recession of 2007-2009 was finally receding in the rear-view mirror, it became clear what had happened.

In response to a tidal wave of foreclosures, buyers began snapping up cheap single-family homes and turning them into rentals. By the early 2010s, institutional investors had discovered real estate as an asset class and picked up momentum, buying homes around the country and often beating out competitors by paying for transactions in cash.

Millions of low- and middle-income families that had owned their homes became tenants instead; in 2016, 25 percent more households were renting their homes than in 2006. It amounted to a giant transfer of wealth from lower-income families to Wall Street and large corporations.

Today, with the coronavirus ravaging the U.S. economy and millions of families struggling to pay their rent or mortgage, many housing advocates fear that the country is teetering on the brink of a similar catastrophe.

“It’s a huge pending problem—we’re very worried,” says Jeff Crum, chief investment officer for New Jersey Community Capital, a community development financial institution (CDFI) that was highly active in preserving affordable single-family homes during the recession. The fear is not only that homeowners may lose their houses. It’s also that landlords whose tenants can’t pay their rent may have to foreclose on the small and mid-sized multifamily buildings that form the bedrock of low-income housing stock in most cities. All of those homes, single-family houses and apartment buildings alike, are fair game for institutional investors.

After all, buyers who can pay with cash have remained engaged around the U.S. In May, the Center for NYC Neighborhoods reported that throughout the city, all-cash investors—who are particularly active in New York—make up 40 percent of the home purchase market. They tend to be concentrated at the bottom of the market, the study said.

That trend could be exacerbated as the pandemic continues, with potentially disastrous outcomes. But the upside of this pandemic, at least as compared to the financial meltdown, is that policymakers and others have a little time to prepare for a coming crisis. And they’re using it. Around the country, housing advocates are thinking about programs that worked last time, policies that need some tweaking, and underutilized models that could potentially have a real impact.

For instance ...

FULL STORY: Lessons from the Last Housing Crisis: How to Get Control of Properties

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

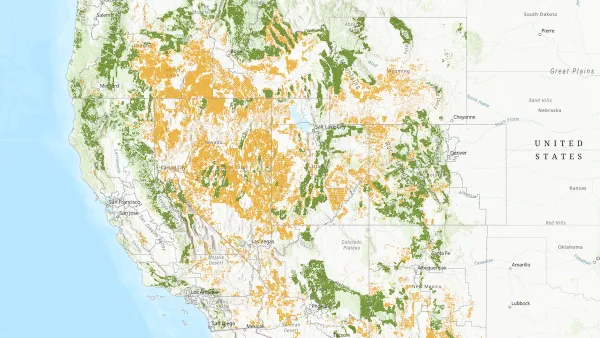

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

California Homeless Arrests, Citations Spike After Ruling

An investigation reveals that anti-homeless actions increased up to 500% after Grants Pass v. Johnson — even in cities claiming no policy change.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)