The state of California is trying to prevent a repeat of one of the most significant consequences of the Great Recession: large Wall Street interests buying for-sale housing in bulk for conversion to apartments.

Oscar Perry Abello writes to summarize the shifting status of the real estate market—from private ownership by individuals to corporate ownership by Wall Street money—and to detail efforts to control the trend in California.

For a succinct description, with the key evidence, of the scope of the trend, Abello writes:

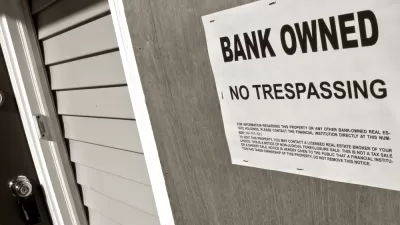

Before 2010, corporate landlords didn’t exist in the single-family market; by March of this year, Wall Street had acquired $60 billion worth of distressed or foreclosed properties across the country, representing hundreds of thousands of homes.

Most of those properties became rentals. Between 2006 and 2012, the number of owner-occupied housing units in California declined by more than 320,000, while the number of renter-occupied housing units increased by more than 720,000, according to the Public Policy Institute of California. In 2006, only 21 percent of occupied single-family houses in California were rented; by 2012, the share of houses occupied by renters had increased to 26.0 percent.

The disruption of the COVID-19 pandemic and the resulting economic downturn are expected to exacerbate the trend, according to a widely circulated article by Ryan Dezember, published by the Wall Street Journal in September. Also widely circulated: the nascent efforts by a few politicians to add regulatory controls to slow large corporate interests from buying up all the distressed properties in the market.

Enter SB 1079, a law recently adopted by the state of California, which makes it harder for big-money investors to buy foreclose properties en masse. Exactly how the law accomplishes that goal—by preventing bulk foreclosure sales and for holding lenders responsible for the upkeep of foreclosed properties—is the focus of Abello's article.

FULL STORY: California’s New Law Gives Communities a Chance to Stop the Private Equity Housing Grab

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

In Urban Planning, AI Prompting Could be the New Design Thinking

Creativity has long been key to great urban design. What if we see AI as our new creative partner?

King County Supportive Housing Program Offers Hope for Unhoused Residents

The county is taking a ‘Housing First’ approach that prioritizes getting people into housing, then offering wraparound supportive services.

Researchers Use AI to Get Clearer Picture of US Housing

Analysts are using artificial intelligence to supercharge their research by allowing them to comb through data faster. Though these AI tools can be error prone, they save time and housing researchers are optimistic about the future.

Making Shared Micromobility More Inclusive

Cities and shared mobility system operators can do more to include people with disabilities in planning and operations, per a new report.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

planning NEXT

Appalachian Highlands Housing Partners

Mpact (founded as Rail~Volution)

City of Camden Redevelopment Agency

City of Astoria

City of Portland

City of Laramie