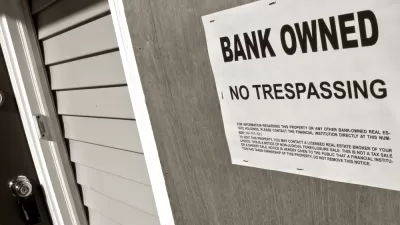

Millions of American property owners are behind on mortgage payments and facing the prospect of foreclosure and eviction later this year.

Kelly Anne Smith reports on the latest efforts by the federal government to the stem an expected flood of foreclosures as pandemic mortgage protections expire later this year.

"A new rule proposal from the Consumer Financial Protection Bureau (CFPB), a federal agency tasked with protecting consumers by enforcing federal consumer financial laws, would create a new pre-eviction review period to grant millions of Americans more time to figure out payment options before Covid-19 federal mortgage protections expire at the end of June," reports Smith.

In February, the Biden administration worked with the U.S. Department of Housing and Urban Development, the Department of Veterans Affairs, and the Department of Agriculture to extend existing foreclosure moratoriums for federally backed mortgage loans, including FHA-insured, VA-guaranteed, and USDA loans, through at least June 30, 2021, according to a separate article by Amy Loftsgordon. Smith notes despite those protections, millions of evictions have occurred through the pandemic despite protections from the centers for Disease Control. Foreclosure sales have also persisted despite federal, state, and local protections.

With uncertainty risking the financial security of both renters and landlords, the CFPB is working to add new protections as the threat of a large wave of evictions continues to loom. The CFPB cited data "estimating nearly 1.7 million borrowers will exit forbearance programs, where a lender allows borrowers to stop making payments for a period of time, in September and the following months," according to Smith. Nearly 2.1 million homeowners in forbearance are already past the 90-day delinquency period, according to CFPB data cited by Smith.

As for more detail about how the proposed foreclosure eviction protections would work, the new rule "would apply to both federally-backed and private mortgages for primary residences," according to Smith. "Until now, federal mortgage protections have only applied to federally-backed mortgage loans. According to the National Housing Law Project, 14.5 million (30%) of all mortgages are privately held."

"Current rules require borrowers to be 120 days delinquent before the foreclosure process can start," and the new rule would loosen "make the process of getting a homeowner into an affordable payment agreement faster, and with less paperwork."

FULL STORY: CFPB Proposes Plan To Prevent Foreclosure Wave. Is It Enough?

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

Amtrak Rolls Out New Orleans to Alabama “Mardi Gras” Train

The new service will operate morning and evening departures between Mobile and New Orleans.

The Subversive Car-Free Guide to Trump's Great American Road Trip

Car-free ways to access Chicagoland’s best tourist attractions.

San Antonio and Austin are Fusing Into one Massive Megaregion

The region spanning the two central Texas cities is growing fast, posing challenges for local infrastructure and water supplies.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Jefferson Parish Government

Camden Redevelopment Agency

City of Claremont