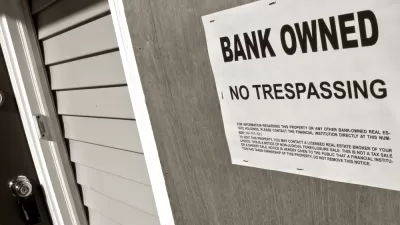

Although homeowners have so far accessed financial relief from the pandemic much more easily than renters, housing counselors are bracing for a foreclosure crisis as forbearance terms start to end.

When Nora Hertel’s husband lost his job working at a small, private school for kids with special needs earlier this year due to the pandemic, their two-income household was instantly scaled down to one. Hertel, a marketing communications specialist at NCALL Research Inc., says she and her husband initially paid their mortgage with money from savings. As months passed, however, the couple started to miss their 15-day grace period and receive penalties.

“It was just getting to the point that by the time I paid the mortgage, the next bill would come in,” Hertel recalls. “And then there were times that I would pay the mortgage and then end up late on my credit card and other things. We just didn’t have enough and I had to choose one or the other.”

For homeowners like the Hertels, the CARES Act provided an option for financial relief by stipulating that single-family homes with a government-backed mortgage are automatically eligible for forbearance if they have been affected, directly or indirectly, by COVID-19. Homeowners who meet this criterion and request assistance are entitled to an initial forbearance period of up to 180 days (6 months) and a one-time extension of an additional 180 days, should they choose to take advantage of it.

Though the CARES Act provision has acted as a safeguard to prevent homeowners from suffering complete devastation at the hands of the pandemic, it has not come without challenges. As with the nationwide eviction moratoriums, housing advocates and counselors say that the conditions of the provision are unclear to the average consumer, particularly relating to their rights and how to manage and exit their forbearance term. As a result, housing advocates and counselors are bracing for a foreclosure crisis in early 2021 once the provision expires on Dec. 31. It’s unclear, however, just how severe next year’s pending crisis might be.

A Skewed Picture

While there is no question that there will be a foreclosure crisis, housing experts say ...

FULL STORY: The Foreclosure Crisis Waiting for Us in January

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

In Urban Planning, AI Prompting Could be the New Design Thinking

Creativity has long been key to great urban design. What if we see AI as our new creative partner?

How Trump's HUD Budget Proposal Would Harm Homelessness Response

Experts say the change to the HUD budget would make it more difficult to identify people who are homeless and connect them with services, and to prevent homelessness.

The Vast Potential of the Right-of-Way

One writer argues that the space between two building faces is the most important element of the built environment.

Florida Seniors Face Rising Homelessness Risk

High housing costs are pushing more seniors, many of them on a fixed income, into homelessness.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Gallatin County Department of Planning & Community Development

Heyer Gruel & Associates PA

JM Goldson LLC

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Jefferson Parish Government

Camden Redevelopment Agency

City of Claremont