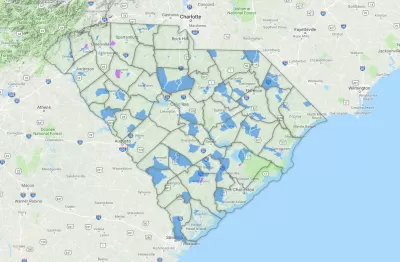

Created to speed investment in struggling communities, the federal Opportunity Zones program could also spur research into how capital can be better deployed on a district-by-district basis.

A product of the GOP's 2017 tax reform bill, the federal Opportunity Zones program proposes to aid "struggling communities" (though there's been some debate on that score) by enabling greater redevelopment investment in specific census tracts. Here, Bruce Katz discusses why the program could spark more comprehensive research into how specific investments impact and interact with their wider environs.

Katz points to some of the common designations for urban districts: central business districts, anchor districts, residential areas, and the like. "For urban officials, practitioners, researchers or residents themselves, these archetypes are so settled that they rarely elicit discussion or debate. Yet the Opportunity Zone tax incentive enables us to think about each of these distinct areas as possible asset classes or investment sectors."

The Opportunity Zone framework, Katz says, is one way to see past the compartmentalization of urban finance. "At a minimum, the creation of Zone typologies could help motivate major institutions within different kinds of Opportunity Zones to consider how to realize their full economic impact."

See also: New Scrutiny for the Federal 'Opportunity Zones' Program

FULL STORY: Rethinking Capital and Geography

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

California Homeless Arrests, Citations Spike After Ruling

An investigation reveals that anti-homeless actions increased up to 500% after Grants Pass v. Johnson — even in cities claiming no policy change.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)