Renters can't access the tax breaks afforded to home buyers, like the mortgage interest tax deduction, so a Terner Center for Housing Innovation paper looks at policies that could put renters on a more even footing with home buyers.

According to an article by Jen Kinney in Next City, almost half of all American renters, "Pay more than a third of their income in rent, and yet federal tax exemptions for homeowners are more than double the subsidies for renters." This policy has big knock-on effects on the popularity of apartments (which are more likely to be rented than houses) and the density of cities. The disparity in how the government treats home ownership compared to renting also fuels wealth inequality, because Kinney explains, "While all homeowners are eligible for tax deductions, only one in four low-income families eligible for housing assistance receive it today."

A paper by the Terner Center for Housing Innovation at UC Berkeley examined two policies to address this issue. The first, which they call the Rent Affordability option would work like this, "All rent-burdened low-income families would receive a tax credit equal to the difference between their income and their rent or the HUD-established fair market rent, to ensure they pay no more than 30 percent of their income in rent." The second is a Rent Reduction option that would, "Provide a credit to more families, 15.1 million, but at a smaller amount: 33 to 12 percent of rent. With an average monthly credit of $227, fewer families would cease to be rent-burdened in this model (defined as spending more than a third of income on rent), but nearly all residents making less than 80 percent of area median income would receive some financial relief."

The paper acknowledges that either of these policies would probably be politically difficult to enact and might need to narrow their aim to help a smaller group like families with children but the authors of the study caution, "Piecemeal solutions to the crisis of rental affordability are inadequate and housing programs funded by appropriations will never be sufficient to address renters’ housing needs."

FULL STORY: Crunching the Numbers on a $76B Tax Credit for Renters

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

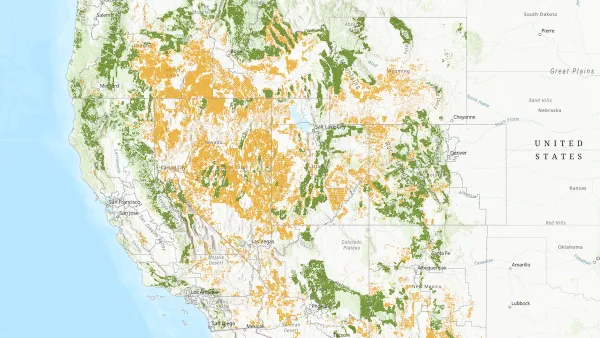

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

California Homeless Arrests, Citations Spike After Ruling

An investigation reveals that anti-homeless actions increased up to 500% after Grants Pass v. Johnson — even in cities claiming no policy change.

Albuquerque Route 66 Motels Become Affordable Housing

A $4 million city fund is incentivizing developers to breathe new life into derelict midcentury motels.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)