Calling the property tax, "probably the most controversial tax in the United States," the Lincoln Institute of Land Policy and the Minnesota Center for Fiscal Excellence have released the "50-State Property Tax Comparison Study" for 2013.

The Lincoln Institute of Land Policy has released its "50-State Property Tax Comparison Study" in partnership with the Minnesota Center for Fiscal Excellence. The goal of the study, according to the Lincoln Institute's website, is to provide accurate data as a foundation for "sound governmental decision-making."

The study examines "effective property tax rates," defined as the actual tax payment as a percentage of market value. As quoted from a press release announcing the report, here are a few of the key points that exemplify the wide variations in property tax policy around the country:

- "Bridgeport, Connecticut continues to impose the highest taxes on median-value homes in urban cities, with an effective rate above 4 percent.

- "The lowest rate, in Columbia, South Carolina, is slightly above .6 percent."

- "The decline in real values in Detroit leaves it with high effective tax rates, but a new revaluation initiative in the city may reduce that rate in the future."

- "The New England region, with its heavy reliance on property taxes, has the highest effective homestead rates, but the Midwest leads with the highest effective rates on commercial property."

- "There was no change between 2012 and 2013 in the top 5 cities with the highest property tax bills on a median-value home."

FULL STORY: 50-State Property Tax Comparison Study

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

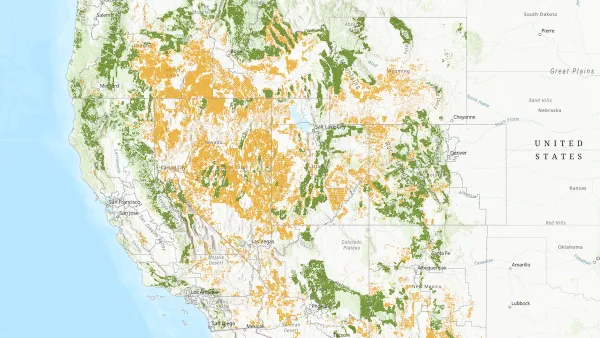

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

California Homeless Arrests, Citations Spike After Ruling

An investigation reveals that anti-homeless actions increased up to 500% after Grants Pass v. Johnson — even in cities claiming no policy change.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)