The popularity of the mortgage forbearance program enabled by the CARES Act is one reason not to fear a housing crash like the Great Recession, yet.

"Mortgage delinquencies hit a record in April, well above anything seen during the Great Recession," reports Andrew Van Dam. "Some 3.4 percent of Americans became at least 30 days delinquent on their mortgage in April, according to a new analysis from CoreLogic."

While such high delinquency rates would usually indicate a sign of a housing crash to come, Van Dam offers a caveat about the many uncertainties of the current economy, and says a housing crash like in the Great Recession isn't certain.

"For starters, the new delinquency figure includes an unknown number of households who are late on their payments because their loans are in forbearance, CoreLogic chief economist Frank Nothaft said." More details on the popularity of the mortgage forbearance program enabled by the CARES Act is included in the source article.

The mortgage delinquencies data also stands in contrast to industry reports of sales of new houses increasing faster than any year since 2005—at the peak of the housing boom of the aughts.

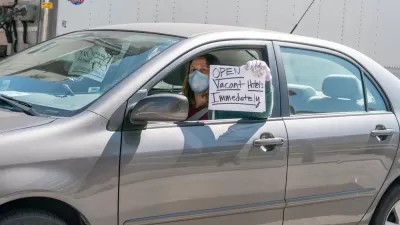

In additional bad news about the economy and health of the housing market, new data from Apartment List indicates that 32 percent of households haven't yet made their housing payments for the month of July.

FULL STORY: An indicator that presaged the housing crisis is flashing red again

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

Amtrak Rolls Out New Orleans to Alabama “Mardi Gras” Train

The new service will operate morning and evening departures between Mobile and New Orleans.

The Subversive Car-Free Guide to Trump's Great American Road Trip

Car-free ways to access Chicagoland’s best tourist attractions.

San Antonio and Austin are Fusing Into one Massive Megaregion

The region spanning the two central Texas cities is growing fast, posing challenges for local infrastructure and water supplies.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Jefferson Parish Government

Camden Redevelopment Agency

City of Claremont