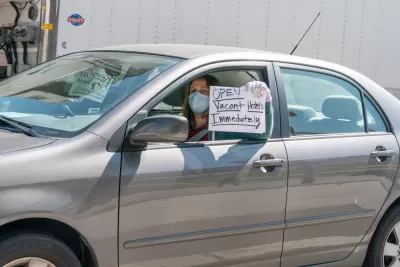

A new report from researchers at the Urban Institute makes the case for federal and state relief for renters and property owners hurt by the economic realities of the coronavirus pandemic.

Aaron Shroyer and Kathryn Reynolds lay out the daunting task of dealing with the housing stress of the economic downturn related to the coronavirus. First, the context of the looming payment crisis, as eviction and mortgage payment moratoriums expire in the coming weeks.

State and federal unemployment assistance, along with eviction moratoria, have helped most renters pay rent and remain stably housed during the crisis. But renter households face a severe cliff at the end of July, when supplemental unemployment assistance from the Coronavirus Aid, Relief, and Economic Security (CARES) Act expires.

The alarm bells sounded by Shroyer and Reynolds should have a familiar ring. Planetizen has been documenting the looming crisis in the housing market since the pandemic started to shut down cities and states around the country, in April, May, and again in June.

At this point in the crisis, Shoyer and Reynolds offer a prescription to help the nation's renters and landlords avoid the worst possible outcomes from the crisis.

In a new brief, we estimate that when state and federal unemployment assistance expires, $15.5 billion per month would be needed to alleviate cost burden for renters who were cost-burdened before the pandemic and for renters who lost their jobs as a result of it.

The article details the housing market and unemployment data that inform that prescription, painting a dire portrait of a housing market teetering above a cliff.

FULL STORY: To Stay Stably Housed, Renters Need $16 Billion per Month in Housing Support during the COVID-19 Crisis

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

California Homeless Arrests, Citations Spike After Ruling

An investigation reveals that anti-homeless actions increased up to 500% after Grants Pass v. Johnson — even in cities claiming no policy change.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)