Tax Increment Financing

Omaha Streetcar Yielding $1.5 Billion in TIF Funds

The line, scheduled for completion in 2027, is bringing billions in new investment to the city’s urban core.

Milwaukee Considers Zoning Reform

The city is looking for ways to boost housing production, anticipating a growing population.

Missoula Approves Tax Increment Financing for Workforce Housing

The funding mechanism exchanges public funding for a certain number of affordable units.

Update: Chicago Red Line Extension TIF Approved

The long-anticipated project that will bring the Chicago Transit Authority rail system into transit deserts on the Southside of Chicago is making substantial progress.

Chicago’s Red Line Extension Environmental Review Complete

The Red Line Extension on Chicago’s South Side could be a game changer, if the city can figure out the local funding.

What Is Redevelopment?

Redevelopment includes all development projects that build new structures and land uses on a previously developed site. Understanding the nuances of redevelopment is critical for understanding the ways cities and communities change.

Equitable Development Plan Aims To Protect Philly's Chinatown

As the historic neighborhood experiences increased redevelopment around the new Rail Park, community activists are working to ensure older residents and businesses aren't displaced in the process.

Chicago Seeks Public Input on Clark Street Improvements

The city is creating a strategy for improvements in the Clark Street corridor to improve the area's walkability and stimulate the local economy.

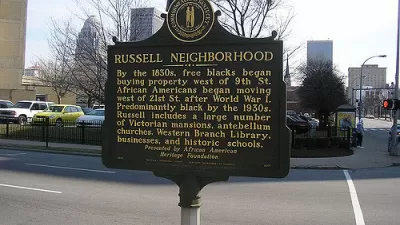

Tax Increment Financing District Considered for West Louisville

A prominently Black and low-income neighborhood in Louisville could gain a new tool for spurring local development—the law is intended also to control the effects of gentrification.

Multi-Modal Bridge Coming Soon to Lincoln Yards Mega-Project in Chicago

Residents of Chicago will soon see some of the fruits of the controversial tax increment financing for the Lincoln Yards project in Chicago's North Side.

Calthorpe Makes the Case for a Corridor-Based Approach to Affordable Housing

Peter Calthorpe's case study of El Camino Real in the Silicon Valley shows the potential for affordable housing development in the land surrounding side right-of-ways.

Tax Increment Financing Reforms Promised by Chicago Mayor Lightfoot

The controversial tax break known as TIF looks headed for reforms in the Windy City, as Mayor Lori Lightfoot promises reforms that ensure more equitable application of the benefits of TIF.

Chicago Planning Commissioner Focuses on Disinvested Neighborhoods

A new initiative seeks to bring investment dollars to Chicago communities that for decades have suffered from the loss of wealth and population.

15 New Special Taxing Districts Approved in Cincinnati

The city of Cincinnati is committing to tax increment financing as a tool to invest in underserved, low-income neighborhoods.

Tax Increment Financing, Explained

CityLab University explains a controversial and misunderstood funding mechanism.

Minneapolis Debates Inclusionary Zoning

The city of Minneapolis approved an interim inclusionary zoning measure in December 2018, but very few projects were subject to the policy. Supporters and opponents of the policy are sparring over the policy's future.

Editorial: Use TIF to Fund Transit Improvements in Chicago

The Chicago Tribune supports the use of tax increment financing to fund a $2.1 billion project to revamp the Red and Purple lines on the CTA system in Chicago.

Lessons in Tax Increment Financing

Vermont enabled tax increment financing (TIF) for the city of Burlington in 1985, in keeping with a nationwide trend at the time. TIF is still a major player in the state's redevelopment efforts to this day.

Editorial Board Calls for Tax Increment Financing Reform in Chicago

The Chicago Tribune says the city of Chicago can't be trusted with tax increment financing (TIF), so it's time for a do-over.

How Mega-Project Financing Tools Gerrymander Distressed Communities

The developers of Hudson Yards received $1.2 billion in financing from the EB-5 program, all made possible by a map that gerrymandered the project into the same neighborhood as Harlem public housing.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

planning NEXT

Appalachian Highlands Housing Partners

Mpact (founded as Rail~Volution)

City of Camden Redevelopment Agency

City of Astoria

City of Portland

City of Laramie