Board of Equalization

ICYMI: 12 States Hiked Gas Taxes on Monday

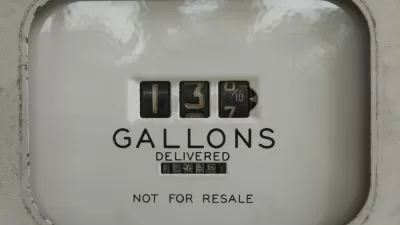

On July 1, Illinois and Ohio increased gas taxes by double digits: 19 cents per gallon and 10.5 CPG, respectively, followed by California at 5.6 CPG, all due to legislation passed this year or in 2017. Diesel tax hikes were even higher.

California Gas Tax Supporters Get Good News from Latest Voter Survey

In a turnaround from prior voter surveys, a poll released Wednesday on November propositions found a slim majority of voters opposed to repealing the state's first legislative gas tax increase since 1989. Rent control opponents received good news too

California's Record Fuel Taxes Hike Passes Legislature in One Day

On April 6, the Senate and Assembly passed a comprehensive transportation funding package that it had been unable to do for years, thanks to much deal-making by Gov. Jerry Brown. The gas tax will increase by 12 cents per gallon on November 1.

San Luis Obispo County Leaders Ponder What's Next After Transportation Measure Fails

The November 8 sales tax measure fell 0.37 percent short, but there's new hope from Sacramento with the reintroduction of a gas tax measure. Democrats now hold the bare supermajority in both the Assembly and Senate needed to pass tax increases.

Greatest Barrier to Reducing Greenhouse Gas Emissions in California: Gas Prices

Gas prices are down and sales are up, and greenhouse gas emissions from transportation, the largest source of the state's emissions, are up, even though overall they dipped. In addition to increased driving, sales of EVs and hybrids dropped.

How High is Too High for Transportation Sales Taxes?

Sales taxes are regressive, but unlike the gas tax, they bear no relationship to transportation. Should a November transportation ballot measure pass, sales taxes in three cities in the county of Los Angeles would exceed 10 percent.

California's Gas Tax Continues to Plummet

Last February, the state Board of Equalization voted to reduce the gas tax by 6-cents. On Tuesday, it voted 3-2 to continue the decrease by 2.2 cents. The vote is required by an arcane rule that translates into tax *decreases when gas prices fall.

Transportation Funding Crisis Looming in California After Revenues Fall

Heretofore, California's transportation funding woes have largely been restricted to future projects, expressed as "deferred road and bridge maintenance." That just changed—now current budgets face a $754 million cut over five years.

State Gas Tax Changes Effective July 1: Six Up; One Down

Carl Davis, Research Director of the Institute on Tax and Economic Policy (ITEP) writes where gas taxes used to fund transportation infrastructure increased, if only by decimal points, and about the aberration—the six-cent plunge in California.

State Gas Tax Update: One Up, One Down

This has been an eventful week for gas taxes. To update two posts that appeared recently, Gov. Terry Branstad of Iowa signed legislation that increases the gas tax by 10-cents on March 1. In California, a board voted to decrease the tax by six cents.

Deep Cut Proposed for California's Gas Tax

A proposal to cut the gas tax by 21 percent would dig a huge hole in the state's transportation budget. It comes from a requirement in 2010 fuel tax swap legislation that doubled the excise tax while reducing the sales tax on gas by 6 percent.

Gov. Brown Sets Ambitious Agenda for Environment, Infrastructure Goals in Fourth Term

The California governor began an unprecedented fourth term by laying out goals to reduce carbon emissions and oil consumption, address road and bridge maintenance, build high speed rail, and construct two huge water tunnels under the Sacramento Delta

Mileage Fee Worries in the Golden State

California's mileage fee pilot program legislation is now law. Dan Weikel of the Los Angeles Times raises two concerns drivers have regarding the switch to a mileage-based fee from a gas tax: privacy and fairness.

California Fuel Consumption Rises—First Time in Eight Years

For the first time since 2006, gasoline consumption in California increased from the prior fiscal year. From July 2013 through June 2014, consumption increased 1 percent.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Jefferson Parish Government

Camden Redevelopment Agency

City of Claremont