Traditionally pro-transit organizations have come out against a proposal to create a new payroll tax to fund bus transit improvements.

Elliot Njus reports on a controversial new under consideration by the Oregon State Legislature.

Senate Bill 1521 would allow transit agencies that collect a payroll tax to also collect up to $1.85 per $1,000 in wages from employees. Rather than being paid by the employer, the new tax would be deducted from the employee's paycheck.

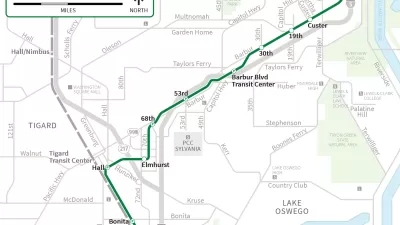

Njus adds: "The additional tax would be restricted to improving or maintaining bus service. It couldn't be used for other modes of transportation, such as light rail." Employers inside the area served by TriMet would be affected by the bill, along with areas served by transit agencies in Lane County, Wilsonville, Sandy, Canby, and South Clackamas.

Njus also provides insight into the political coalitions on either side of the bill's issues. Some traditionally pro-transit groups have already come out in opposition to the bill.

Michael Andersen followed that mainstream news coverage of the bill with an in-depth article for Bike Portland. Andersen provides additional details about how the tax would work, before noting the amount of funding it would create and the service capacity that funding would allow. Andersen also provides more ink to the opinions of the organizations opposing the bill, "because the tax would fall flatly on both rich and poor workers…"

FULL STORY: Bill would let TriMet, other transit agencies tax employees' wages

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

In Urban Planning, AI Prompting Could be the New Design Thinking

Creativity has long been key to great urban design. What if we see AI as our new creative partner?

King County Supportive Housing Program Offers Hope for Unhoused Residents

The county is taking a ‘Housing First’ approach that prioritizes getting people into housing, then offering wraparound supportive services.

Researchers Use AI to Get Clearer Picture of US Housing

Analysts are using artificial intelligence to supercharge their research by allowing them to comb through data faster. Though these AI tools can be error prone, they save time and housing researchers are optimistic about the future.

Making Shared Micromobility More Inclusive

Cities and shared mobility system operators can do more to include people with disabilities in planning and operations, per a new report.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

planning NEXT

Appalachian Highlands Housing Partners

Mpact (founded as Rail~Volution)

City of Camden Redevelopment Agency

City of Astoria

City of Portland

City of Laramie