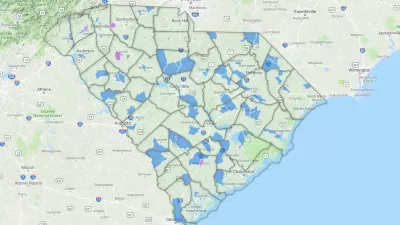

A big day for developers as the Treasure Department paved the way for an anticipated $100 billion in private investment in underserved communities.

"The Treasury Department on Friday released its first round of rules and guidance on the federal Opportunity Zones program, which was created in the tax cut bill passed by Congress last year and uses large capital gains tax breaks to incentivize investment into designated low-income areas," reports Joe Sonka.

"While there is one final round of federal guidance for the program expected before the end of the year, a number of groups invested in the outcome of Opportunity Zones hailed last week’s rules for providing clarity on what type of investments would qualify for the tax break, and allowing flexibility for how and when such investments must be deployed into development and business projects," adds Sonka.

After the announcement of the new guidance from the Treasury Department, observers on either side of the aisle had less than enthusiastic responses to the newly revealed details of the program. Writing for the Center for American Progress, Olugbenga Ajilore argued that the program ignores low-income communities in favor of the wealthy and corporations. Writing for the Washington Examiner, Colin Wilhelm seems included to agree, claiming that the Treasury Department's guidance is a clear win for the real estate industry, with much less clear benefits for low-income Americans.

For more background, see previous Planetizen coverage of the Opportunity Zones program.

FULL STORY: Treasury releases first round of rules on Opportunity Zones, giving flexibility to developers

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

San Francisco Suspends Traffic Calming Amidst Record Deaths

Citing “a challenging fiscal landscape,” the city will cease the program on the heels of 42 traffic deaths, including 24 pedestrians.

Amtrak Rolls Out New Orleans to Alabama “Mardi Gras” Train

The new service will operate morning and evening departures between Mobile and New Orleans.

The Subversive Car-Free Guide to Trump's Great American Road Trip

Car-free ways to access Chicagoland’s best tourist attractions.

San Antonio and Austin are Fusing Into one Massive Megaregion

The region spanning the two central Texas cities is growing fast, posing challenges for local infrastructure and water supplies.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Jefferson Parish Government

Camden Redevelopment Agency

City of Claremont