Fifty years of the Fair Housing Act hasn't been enough to stop banks and mortgage lenders from discriminating against people of color. Some bad actors are worse than others, though the whole industry in the aggregate is hardly free from indictment.

The Center for Investigative Reporting's "Reveal" platform released a bombshell report this week that finds evidence of mortgage lenders denying home loans to people of color at higher rates than for white people.

According to an article sharing news of the study, nearly two-thirds of mortgage lenders rejected people of color at higher rates, but there were a few extreme examples. The article lists the worst offenders as TD Bank and Capital One. "African American and Latino borrowers are more likely to get turned down by TD Bank than by any other major mortgage lender," according to the article. "The bank turned down 54 percent of black homebuyers and 45 percent of Latino homebuyers, more than three times the industry averages," write Aaron Glantz, Emmanuel Martinez, and Jennifer Gollan.

The article notes the rise of mortgage lenders since the Great Recession—unlike banks, mortgage lenders "are not required to follow Community Reinvestment Act rules to lend to low-income borrowers and in blighted communities." That lack of regulation creates lenders like Ruoff Home Mortgage, which "made 92 percent of its 5,300 conventional home loans to whites in 2015 and 2016" despite operating in a city with a large African-American community. The article includes more examples of banks taking advantage of loopholes to avoid loaning to people of color or to avoid the appearance of discrimination.

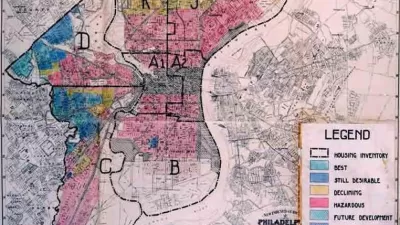

In addition to the article calling out specific banks and mortgage lenders for discriminatory practices, Glantz and Martinez also author the full report, titled "Kept Out." The report includes interactive infographics, testimonials, more explanation of discriminatory practices among banks and lenders, and a case study from Philadelphia.

FULL STORY: 8 lenders that aren’t serving people of color for home loans

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

In Urban Planning, AI Prompting Could be the New Design Thinking

Creativity has long been key to great urban design. What if we see AI as our new creative partner?

Cal Fire Chatbot Fails to Answer Basic Questions

An AI chatbot designed to provide information about wildfires can’t answer questions about evacuation orders, among other problems.

What Happens if Trump Kills Section 8?

The Trump admin aims to slash federal rental aid by nearly half and shift distribution to states. Experts warn this could spike homelessness and destabilize communities nationwide.

Sean Duffy Targets Rainbow Crosswalks in Road Safety Efforts

Despite evidence that colorful crosswalks actually improve intersection safety — and the lack of almost any crosswalks at all on the nation’s most dangerous arterial roads — U.S. Transportation Secretary Duffy is calling on states to remove them.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Appalachian Highlands Housing Partners

Gallatin County Department of Planning & Community Development

Heyer Gruel & Associates PA

Mpact (founded as Rail~Volution)

City of Camden Redevelopment Agency

City of Astoria

City of Portland

City of Laramie