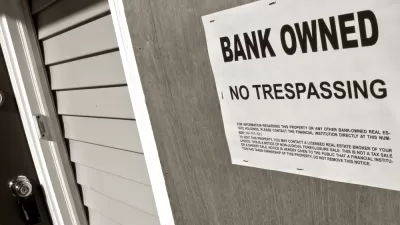

According to a new study, richer borrowers drove the economy off the cliff in the housing crash of the Great Recession.

"Mounting evidence suggests that the notion that the 2007 crash happened because people with shoddy credit borrowed to buy houses they couldn’t afford is just plain wrong," writes Gwynn Guilford. "The latest comes in a new NBER working paper [pdf] arguing that it was wealthy or middle-class house-flipping speculators who blew up the bubble to cataclysmic proportions, and then wrecked local housing markets when they defaulted en masse."

"Analyzing a huge dataset of anonymous credit scores from Equifax, a credit reporting bureau, the economists—Stefania Albanesi of the University of Pittsburgh, the University of Geneva’s Giacomo De Giorgi, and Jaromir Nosal of Boston College—found that the biggest growth of mortgage debt during the housing boom came from those with credit scores in the middle and top of the credit score distribution—and that these borrowers accounted for a disproportionate share of defaults," according to Guilford.

(Note: this article relying on evidence supplied by anonymous data from Equifax was published several days before the news broke about hackers gaining access Equifax's records of confidential information pertaining to about 143 million Americans.)

According to this analysis, at least, the borrowing of those with low credit scores—the 'subprime' borrowers who supposedly caused the crisis—"stayed virtually constant throughout the boom."

As Guilford hinted at the top of the article, there is another study by Antoinette Schoar, a finance professor at MIT Sloan, that also backs the emerging narrative about how wealthier market players, with better credit, drove the rise in delinquencies in the market at the time of the crash.

FULL STORY: House flippers triggered the US housing market crash, not poor subprime borrowers

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Chicago’s Ghost Rails

Just beneath the surface of the modern city lie the remnants of its expansive early 20th-century streetcar system.

San Antonio and Austin are Fusing Into one Massive Megaregion

The region spanning the two central Texas cities is growing fast, posing challenges for local infrastructure and water supplies.

Since Zion's Shuttles Went Electric “The Smog is Gone”

Visitors to Zion National Park can enjoy the canyon via the nation’s first fully electric park shuttle system.

Trump Distributing DOT Safety Funds at 1/10 Rate of Biden

Funds for Safe Streets and other transportation safety and equity programs are being held up by administrative reviews and conflicts with the Trump administration’s priorities.

German Cities Subsidize Taxis for Women Amid Wave of Violence

Free or low-cost taxi rides can help women navigate cities more safely, but critics say the programs don't address the root causes of violence against women.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

planning NEXT

Appalachian Highlands Housing Partners

Mpact (founded as Rail~Volution)

City of Camden Redevelopment Agency

City of Astoria

City of Portland

City of Laramie