The Times delves deep into the financial incentives that cities, counties, and states dole out to corporations to lure jobs and economic development to their corner of the country. Just what does the $80 billion spent each year actually buy?

Once focused on automakers, and now sought by everyone from Caterpillar to Facebook, governments in every corner of America "who are desperate to create jobs, outmatched by multinational corporations and short on tools to fact-check what companies tell them" use incentives to attract and keep businesses large and small without a clear indication that those investments ever pay off. "For local governments, incentives have become the cost of doing business with almost every business," says Louise Story. "The Times found that the awards go to companies big and small, those gushing in profits and those sinking in losses, American companies and foreign companies, and every industry imaginable."

Exploiting local fears that companies would move jobs overseas, or over county lines, corporations have created "a high-stakes bazaar where they pit local officials against one another to get the most lucrative packages. States compete with other states, cities compete with surrounding suburbs, and even small towns have entered the race with the goal of defeating their neighbors."

At the same time that local governments are cutting back on services, they're creating new tax credits and exemptions. And while incentives take many forms - cash grants and loans; sales tax breaks; income tax credits and exemptions; free services; and property tax abatements - it's unclear how effective certain ones are over others, or over nothing, because government agencies and officials "rarely track how many jobs are created," notes Story. "Even where officials do track incentives, they acknowledge that it is impossible to know whether the jobs would have been created without the aid."

This article is the first in the Times' United States of Subsidies series. The series is accompanied by an extensive interactive database of incentives cataloged by state and company.

FULL STORY: As Companies Seek Tax Deals, Governments Pay High Price

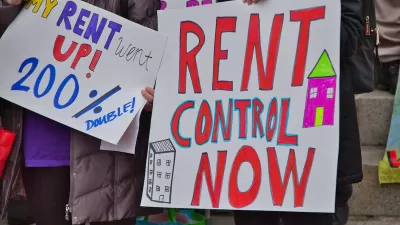

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

In Urban Planning, AI Prompting Could be the New Design Thinking

Creativity has long been key to great urban design. What if we see AI as our new creative partner?

King County Supportive Housing Program Offers Hope for Unhoused Residents

The county is taking a ‘Housing First’ approach that prioritizes getting people into housing, then offering wraparound supportive services.

Researchers Use AI to Get Clearer Picture of US Housing

Analysts are using artificial intelligence to supercharge their research by allowing them to comb through data faster. Though these AI tools can be error prone, they save time and housing researchers are optimistic about the future.

Making Shared Micromobility More Inclusive

Cities and shared mobility system operators can do more to include people with disabilities in planning and operations, per a new report.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

planning NEXT

Appalachian Highlands Housing Partners

Mpact (founded as Rail~Volution)

City of Camden Redevelopment Agency

City of Astoria

City of Portland

City of Laramie