Inclusivity requirements should be used with caution. Increasing the portion of below-market housing units tends to reduce total housing production, particularly moderate-priced homes.

Many jurisdictions apply inclusivity policies that require developers to sell or rent a portion of units at prices that are affordable to low-income households. The profitable, market-priced units subsidize below-market housing.

These subsidies are considered a community contribution that developers pay for the privilege of doing business in an area. Where land prices are escalating due to market trends or public improvements such as a new transit station or upzoning, affordability mandates can capture some of the profit that would otherwise go to property owners and developers, an economic transfer from wealthy to poor households.

Research indicates that inclusionary policies can increase affordable housing supply and social integration, but if applied to less profitable projects they may reduce desirable development, particularly moderate-priced housing. As a result, affordability mandates must be carefully designed to avoid causing unintended harms.

For example, in my city of Victoria, Canada, a 10-15% inclusivity target [pdf] was recently proposed, but one council member suggested increasing this to 30%. Would tripling the requirement triple the number of affordable units? Almost certainly not.

A key factor is the ratio of profit-generating to subsidy-requiring units. For example, if a unit costs $350,000 to build but must be sold for $150,000, it requires a $200,000 subsidy. With a 10% inclusivity requirement, the nine market-rate units bear a $22,222 cost, but with a 30% requirement, each of seven market-rate units bears an $85,714 cost, nearly four times higher, because a larger subsidy must be borne by fewer market-priced units. A moderate-priced unit might be profitable with an additional $22,000 cost burden, but not with an $85,714 burden, so developers will build fewer of them.

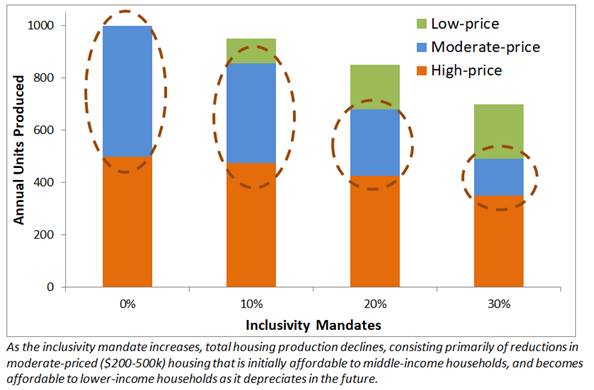

Let me illustrate the results. Assume that with no affordability mandate, the market would produce 1,000 units a year, half high-priced (over $500,000 per unit) and half moderate-priced ($200,000-500,000), but total production is reduced 5% by a 10% mandate, 15% by a 20% mandate, and 30% by a 30% mandate.

|

Mandate |

0% |

10% |

20% |

30% |

|

Production reduction |

0% |

5% |

15% |

30% |

|

High-price (over $500k) |

500 |

475 |

425 |

350 |

|

Moderate-price ($200-500k) |

500 |

380 |

255 |

140 |

|

Low-price (under $200k) |

0 |

95 |

170 |

210 |

|

Total |

1,000 |

950 |

850 |

700 |

As the inclusivity mandate increases, total housing production declines, consisting primarily of reductions in moderate-priced housing that is initially affordable to middle-income households, and becomes affordable to lower-income households as it depreciates in the future, a process called filtering. The graph below illustrates these impacts.

In this case, tripling the inclusivity requirement adds 115 low-priced housing units, but reduces total housing production by 300 units of which 240 are moderate-priced. Does this increase or reduce affordability overall? This depends on how affordability is defined. It sometimes refers to subsidized housing built specifically for low-income households (typically, the lowest income quintile), but a broader definition recognizes that many middle-income households (second and third income quintile) pay more than is considered affordable (30% of income for housing or 45% for housing and transportation combined). Increasing affordability mandates tends to increase the supply of housing that meets the first definition but reduces supply that meets the second definition, and because housing tends to become more affordable over time, it reduces future affordable housing supply by both definitions.

Let me describe a specific example that illustrates these effects. A few years ago a local developer proposed the Bohemia and Castana, a pair of three- and four-storey mixed-use buildings with 71 residential units, a third of which were to be moderate-price rentals. Neighborhood residents objected. They considered the buildings too big and tall, although critics could never explain exactly how a fourth storey would harm them. Never-the-less, the opponents were successful: the City rejected the proposal. The developer instead constructed a three-storey building with 51 condominiums but no rental units. In a city with nearly 50,000 houses, 20 fewer moderate-priced units is too small to notice, but if this is typical, it indicates that development restrictions typically reduce moderate-priced infill housing development by about 30% compared with what the market would deliver.

Although the magnitude of these impacts will vary depending on conditions, these effects are likely to occur in most situations, particularly where moderate-priced housing is less profitable. This suggests that higher inclusivity requirements may be suitable where there is very strong demand for new housing, so developers will build as many units as allowed even if some sell at a loss, but softer markets with lower profits and higher risks require lower requirements or exclusions for moderate-priced units to maximize overall affordability.

Who Benefits or is Harmed by Inclusivity Mandates

Benefits |

Harmed |

|

|

Although inclusivity requirements may be appropriate in some situations, to maximize total benefits they should:

-

Not apply to smaller projects, such as fewer than 20 units.

-

Not apply to moderate-priced units, such as less $500,000.

-

Not apply to developments in less attractive, higher-risk locations where maximum development is desired.

-

Not substitute for other policies that support more compact, affordable infill.

For More Information

Grounded Solutions Network Inclusionary Housing Website

Bento A, Lowe S, Knapp GJ and Chakraborty A. (2009), “Housing Market Effects of Inclusionary Zoning,” Cityscape: A Journal of Policy Development and Research, Vol. 11(2), pp. 7–26.

Dan Bertolet and Alan Durning (2016) Inclusionary Zoning: The Most Promising—Or Counter-Productive—Of All Housing Policies. Great Good or Great Bad, Depending on Design, Sightline Institute.

Emily Hamilton (2018), Is Inclusionary Zoning Creating Less Affordable Housing? Strong Towns.

Sanford Ikeda and Emily Washington (2015), How Land-Use Regulation Undermines Affordable Housing, Mercatus Center at George Mason University.

Location Efficiency Hub provides a suite of web-based tools to help planners, developers and individuals identify and create location-efficient communities.

Todd Litman (2016), Affordable-Accessible Housing in a Dynamic City: Why and How To Support Development of More Affordable Housing In Accessible Locations, Victoria Transport Policy Institute.

Tom Means and Edward P. Stringham (2010), Unintended or Intended Consequences? The Effect of Belowmarket Housing Mandates on Housing Markets in California, San Jose State University.

Mukhija, et al. (2015), “The Tradeoffs of Inclusionary Zoning: What do We Know and What do We Need to Know?” Planning Practice & Research, Vol. 30(2), pp. 222-235.

National Housing Conference is dedicated to ensuring safe, decent and affordable housing for all in America. It includes information on inclusivity policies.

Daniel Shoag (2019), Removing Barriers to Accessing High-Productivity Places, The Hamilton Project.

Benjamin Schneider (2018), Inclusionary Zoning, CityLab

ULI (2016), The Economics of Inclusionary Development, Urban Land Institute.

Wellesley Institute Inclusionary Housing Recommended Papers and Reports.

Maui's Vacation Rental Debate Turns Ugly

Verbal attacks, misinformation campaigns and fistfights plague a high-stakes debate to convert thousands of vacation rentals into long-term housing.

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Chicago’s Ghost Rails

Just beneath the surface of the modern city lie the remnants of its expansive early 20th-century streetcar system.

Bend, Oregon Zoning Reforms Prioritize Small-Scale Housing

The city altered its zoning code to allow multi-family housing and eliminated parking mandates citywide.

Amtrak Cutting Jobs, Funding to High-Speed Rail

The agency plans to cut 10 percent of its workforce and has confirmed it will not fund new high-speed rail projects.

LA Denies Basic Services to Unhoused Residents

The city has repeatedly failed to respond to requests for trash pickup at encampment sites, and eliminated a program that provided mobile showers and toilets.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

planning NEXT

Appalachian Highlands Housing Partners

Mpact (founded as Rail~Volution)

City of Camden Redevelopment Agency

City of Astoria

City of Portland

City of Laramie