The U.S. Department of Housing and Urban Development has a plan to help the nation's hardest hit homeowners and neighborhoods. But by concentrating assistance in the most devastated areas, few places will be saved, writes Charles Buki.

This is the third part in an ongoing series of articles on the state of community development in America.

The Housing and Economic Recovery Act (HERA) of 2008 (Neighborhood Stabilization Fund) is well intentioned. It requires states to "give priority emphasis and consideration" to the areas in greatest need. HUD and its advisors determined that the places in America where greatest need exists are those areas with high combinations of mortgage delinquency, default risk, actual foreclosure, declining home prices, reduced collateral, high unemployment, and abandoned housing. No kidding!

This is tantamount to evaluating the American Community Survey, Home Mortgage Disclosure Act (HMDA) data, sales data, and labor statistics, and concluding that the weakest parts of the weakest markets are the weakest parts of the weakest markets. What sort of genius it took to figure this out is anybody's guess, but it's a good bet that it was gestated in the womb of a community development field and movement quite unwilling to separate the affordable housing needs of low-income households from the negative impacts that concentrations of poverty impose on markets our own practices birthed and perpetuate.

States do have some flexibility in determining how exactly they can deploy their share of these funds. But not much. HERA requires that resources be allocated where there is the greatest percentage of foreclosures. This rifles scarce dollars where the asset base of physical stocks needed to hold the line against continued market failure is the weakest, and thus exactly where deep resources - far deeper than what's in the fund - are needed. HERA requires that resources be allocated where subprime activity is the most significant. This aims scarce dollars where human capacity is the weakest, without financial literacy and unable to navigate the risky terrain of predatory lending. And HERA requires that resources go to areas with the most foreclosures, thereby attaching dollars to the markets where demand is weakest. Not surprisingly, with some exceptions, these are the weakest areas of the weakest urban centers, and almost precisely the geographies where we community developers have been working so hard to turn things around for so long.

To be clear, what this means is that the majority of the places where Community Development Block Grant (CDBG) and HOME and Low Income Housing Tax Credit (LIHTC) dollars have been spent over the last 30 years - the places historically in greatest need - are the exact places where Neighborhood Stabilization Fund dollars are now targeted to go. In other words, the places that have historically been those in greatest need are still today the places in greatest need. It is into these places where we community developers have been working the last thirty years, with one tweaked form or another of the same tools and dollars now contained in the Neighborhood Stabilization Fund.

In essence, the areas where we have severe blight and indications of more blight to come are basically the same as they ever were (with additions such as Nevada and Arizona and Florida). And the tools we have with HERA are in actuality little different (in that the constraints are basically the same except for some Low-, Moderate- and Middle-Income allowances in HERA) than those we have been using (CDBG, HOME, LIHTC). The conclusion: same places, same indicators, same constraints, same tools, same outcome. If junk in equals junk out, how in the world are we ever going to move our community development selves into an alternative future that thinks differently about the challenges we face in our cities and low-income suburban and rural communities? That functions differently? That asks different questions? That turns off our "greatest need" hard-wiring, and flips on our "greatest chance of success" receptors?

Like Detroit, now struggling to face the fact that a flawed business model is at the center of its inability to succeed, the community development field - we housing advocates, neighborhood revitalization strategists, homeless supportive agencies, social service case managers, tax credit junkies - must acknowledge that our business model is broken. It has to be rethought, prototyped, rebuilt, tested, tested again. We must disabuse ourselves of underlying assumptions contained in our current business practices.

Revising Measurements

First among these is our belief that our activities - the number of people counseled, the number of new apartments built, the number of federal dollars - is a good measure of our work. It's not. This has to change. I recall a meeting in a northeastern city five years ago whereupon, having asked how the city could claim success in community development, an agency director said, "we financed the pre-purchase counseling of 2,000 families last year." When asked how many of them ended up qualifying for a loan, then bought a loan, and then made it through the first year, the response was "that's not what we measure."

Second, our field is smitten with the production of housing. We have built en entire community development apparatus predicated on producing units of housing. This approach has always enjoyed the balm of not having to ask why existing houses are vacant. In making the community development problem a housing problem and a housing problem a supply issue, the real challenge of demand - weak where weak households and older housing are co-located - is avoided. In avoiding the demand side of the problem, we avoid the work of racial integration and class segregation embedded in a choice-based market. We avoid the hazards of choice outlined by Nobel Prize winner Thomas Schelling. We avoid the work of locating the supplies that are needed in markets where there are jobs. Just last year I evaluated two dozen CDCs in a large American city, only one of which was capable of production at scale. Yet when pressed about why production in the city was occurring in terribly weak neighborhoods, I was told "resistance would be too high in stronger markets for our product." When pressed further about possibly changing the product line to be more mixed, the response was: "then we'd not produce as many units."

Third, our field takes the easy path too often. By definition, capitalism will allocate rewards unevenly, and most especially to the detriment of those who rely on wages for income; there will always be poverty. But today's poor parents need not raise tomorrow's poor children. If there is one kernel of accumulated community development wisdom, it's that concentrations of poor households virtually guarantee that poverty becomes multigenerational. Yet we almost never intentionally undertake the work of deconcentrating poverty (Hope VI and voucher portability being two notable exceptions). We would prefer to lower rents to assure today's parents of affordable housing, even if the price is to concentrate poor households, than to serve fewer more smartly through harder scattered site work, and tougher development activity in the suburban jurisdictions where jobs have been. A few months ago, I asked a housing agency director about a decision to pursue affordable housing development in a very weak market. I was told "that's where the poor are."

"That's not what we measure." "Then we'd not produce as many units." "That's where the poor are." These are not wrong answers to hard questions so much as they indicate that we're still unclear how much of community development is about healthy communities and how much is about fighting poverty and how much is about affordable housing. Together, an output orientation, a focus on production, and a tilt to take the easy route, have accounted for the deployment of billions of community development dollars into the wrong neighborhoods. As the Housing and Economic Recovery Act of 2008 is only marginally different in structure, it's fair to conclude this new $3.92 billion effort will be just about as effective. We need to make better choices, choices that are harder, more painful, and themselves not guaranteed to work. The little bit of maneuvering room that states have that is contained in the Neighborhood Stabilization Fund should be claimed so that areas in greatest need are served as intended, but areas with the greatest chance for success are the real focus of the work.

Assessing Need and Weighing Efficacy

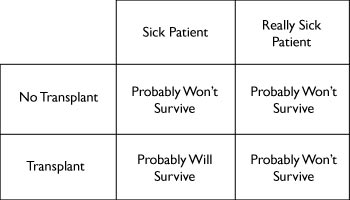

How would this play out? Imagine a hospital with two sick patients, both in need of one heart available for transplant.

The sickest of the two is likely to die very soon without a transplant, and given low odds of surviving with a new organ. The other won't die right away, but much more time without a transplant will mean her future will be at much greater risk, and it is very likely that with a transplant she will survive. There are no certainties either way, but medical history and expert judgment confirm this prognosis.

If today's community development apparatus in America were installed at this hospital to make a recommendation about which of two sick patients gets the one available organ, the decision would be to give the heart to the sickest of the two.

Asked why, the response would be that the data are incontrovertible: the toughest neighborhoods in Albany, or Bridgeport, or Detroit, or Youngstown, or Philadelphia should receive rare precious assistance. And this would be accurate. But it is not the whole truth.

These are places in real trouble. But real trouble - the kind found in such communities - requires real resources. And however large the current Stabilization bill is, it's not nearly large enough to dig out the most troubled markets.

Not nearly enough. What follows is an illustration of an archetypal city facing massive challenges that HERA ought to be addressing.

A Typical Challenged City

It is a very troubled American city of about 130,000, in which perhaps 2,000 households will fail.

This city has about 1,200 blocks, so each block has on average 1.7 foreclosures. To this challenge HERA will flow roughly $5.7M designed to a) increase affordable workforce housing, b) maximize revitalization impacts, c) buy foreclosed properties to create affordable and supportive housing, and d) do so near transit.

When the data (qualitative as quantitative) for this city is unpacked, not all of the 2,000 failures are going to be in one area; they will be scattered. And will be scattered unevenly. At the top of the market, a handful of basically healthy neighborhoods will have a few foreclosures, perhaps five percent (100). In the middle, a handful of neighborhoods will have about 25 percent (500). In the bottom neighborhoods, the traditional CDBG-HOME-LIHTC neighborhoods (those always most in need) will have about 70 percent (1,400). The healthy neighborhoods will average about one foreclosure every four blocks. The middle, or transitional (at risk) neighborhoods will average about three foreclosures every two blocks. The distressed neighborhoods will average about three per block. In fact, when the drill down is deeper, the healthy neighborhoods will divisible again, so the best streets will have no foreclosures, and those that are softest will have one per block. In the middle the best will have one per block and the softest about three. At the bottom, the best of the worst will have about three and the most distressed may have half a dozen or more. And at the very bottom, where there are more multifamily, more older multifamily, and more weak landlords, the numbers are staggering. For this city, $5.7M could be evaporated on one block in the toughest neighborhood. And after these funds have gone into this one street, employment prospects would remain bleak. Education levels of tenants would remain uncompetitive. The capacity of the owner occupants to hold the line would be low. And the next street over, equally troubled, would completely fail.

At the same time, the healthiest neighborhoods will be able to withstand the pressures imposed on them by a few foreclosures and by reductions in property values. Residents in these healthy neighborhoods will cut back, but they will remain employed and will survive. Less leveraged in real estate, they will emerge fine without any Neighborhood Stabilization Funding.

But the middle neighborhoods, the ones that we tend to neglect in community development, the ones with some marketable physical assets and some residential capacity, will be hard-pressed to make it through to the other shoreline without an intervention. With three foreclosures per block and a soft sellers market, these three can infect as many as a dozen others. On the stronger blocks in really distressed areas, four, five, six foreclosures per block are unsustainable without assistance.

The difference is that blocks in the middle have marketable assets on 70 percent of their parcels, whereas in distressed areas, this figure is often below 10 percent whether or not there is a foreclosure crisis. It's these sickest of all neighborhoods where we have spent our CDBG and HOME and LIHTC dollars, where these dollars have not changed markets, where HERA dollars are now slated to go, and where, I predict, little improvement will result. And it's the middle markets, where families are not struggling with incomes below 50 percent of average median income (AMI) but are working households at 70-110 percent of AMI, where resident capacity exists and can be leveraged, where physical assets exist and can be grown, yet where our focus by statute can really only glancingly be. This is a terrible mistake. Innovative states can eke out a little maneuvering room and decide to allocate HERA dollars to these middle LMMI communities, but the surgical precision with which such deployment efforts must occur requires a change in mindset. The bias at the state and municipal levels must be towards those areas with the greatest chance of success. Towards those areas with measurable resident capacity to dig out and hold the line and physical assets possessing marketable qualities capable of generating and sustaining demand.

Intelligent Intervention

The standard against which all initiatives should be measured is whether the intervention makes sense in the marketplace. As my colleague David Boehlke has noted: "If many good houses are not selling on stabler blocks, there is little public purpose in attempting to sell less desirable houses on more troubled ones." And even when sales are possible on less desirable streets, they usually only sell to weaker households with fewer choices, the same households that lack the capacity to impose on a neighborhood high (and marketable) standards of care needed for stabilization. This is not semantics. You can't stabilize a neighborhood without a critical mass of stable families. So if the program guidelines aren't at the outset tilted to attract and retain strong families to marketable streets, it's very unlikely stabilization will occur. At the very least, money spent on property development will be less useful when not accompanied by robust efforts at resident leadership development and organizing specifically tied to making neighborhoods more competitive.

History has been pretty clear, if cruel, that anything less than very substantial and concentrated resources will fail to drive market change. Indeed, the success of the Hope VI program confirms that desegregating poverty and weaving back together separated communities is what can work, and to a significant degree this is a result not only of sound strategy, but use of overwhelming force.

Which brings us back to the reason that the deployment criteria determining at the state level how each state should spend its share of the Neighborhood Stabilization Fund is really about a much larger issue, one front and center as a new administration comes to Washington: what constitutes the work of community development, especially in an era of scarce resources?

Is community development a proxy for resident leadership development? Is it urban real estate development in weak markets? Is it the preservation and production of affordable housing in expensive areas? Is it regional in nature? Is it capacity building? Gap financing?

We are faced with two very sick patients and one healthy transplantable heart.

The work we face is both distributional in terms of how to deploy the one healthy heart we have, and preventional in terms of rethinking how we do business. It's time we stop applying yesterday's business model to today's challenge of community development - and that the comment period we are now in with the Neighborhood Stabilization Fund is a very good place to start.

An Opportunity to Comment and Rethink

Right now each state has another few days to receive and consider comment on the state-determined deployment formulas now under consideration. We have now an opportunity to both rethink the underlying governing variables of our work - what constitutes community development - and how to pursue the objectives embedded in it. Indeed the era of extreme resource scarcity we are now in gives us a very good opportunity to evaluate and redefine the former in order that we do a better job with the latter.

The following handrails may be helpful both as we go forward with the review and comment of the various states' stabilization fund deployment plans, and as we migrate to a (hopefully) new phase of community development shaped in part by our field seizing this moment to upload improvements we'd make to HERA and use them to shape tomorrow's practices.

- First, it's not about the house, and it's not about the city. It's about the neighborhood and the region. People reside in a home, and may work in a city, but they delight on their streets, and they function in a region. Policies and programs have to be neighborhood-centric and set in a regional context. It no longer makes sense to have housing authorities in cities when vouchers are portable, housing markets are fluid, people change jobs, and the range of the activities in their lives occur with little regard for municipal boundaries.

- Second, it's about outcomes, not outputs. We seem hardwired to calibrate work and set direction based on the volume of our efforts, not the impacts our work generates. The number of units in service, in the pipeline, on the drawing boards, or - sadly - in or near foreclosure - is not the point except as indications of some of the inputs that ultimately shape the quality of our neighborhoods, the livability of our streets, the strength of our housing markets. Outputs are to community development what home runs are to offensive production in baseball: one of many indicators, but hardly the central one. Certainly the one measure that counts when understanding neighborhood distress is weak demand. There is almost no good argument for curing this problem with more supply so long as the underlying characteristics of the community remain the same.

- Third, indicators. As a friend of mine in Major League Baseball says, "the thing that most people miss is that figuring out what to measure is the critical first step; the measuring and the analyzing is the easy part." The work of figuring out what to measure is a large part of what we should be doing now, because the baselines we're now collecting and the indicators we're now using all orient decision-making towards the donation of the one healthy organ to the sickest of the two patients in the hospital needing a transplant.

- Fourth, and finally, the question: what problem are we trying to solve in community development? We use housing tax credit dollars ostensibly to provide equity financing to low-income housing projects that need cost gaps closed. But as often as not, tax credit projects are pursued to generate development fees to keep the nonprofit in business, or to lower rents. Both are worthy goals. But if the work is about creating a healthy housing market, then this would be the wrong intent and the wrong tool.

We use housing vouchers ostensibly to provide tenants with portability options so they can participate in the housing market as customers. But often as not, vouchers have become the means for a housing authority to remain operational, so getting vouchers becomes the problem to solve, not enabling low-income citizens to obtain housing. Both are worthy goals. But again, if the work is about creating livable communities, then this is the wrong intent and a misapplication of an otherwise useful tool.

We are on the verge of moving $3.92B into hard-pressed communities, using these funds purportedly to address the foreclosure crisis and declining home values, but aiming our weapons towards a misguided mandate to preserve and create affordable housing, the one thing these neighborhoods have too much of.

Which returns us to those basic, nagging questions. Is community development about the alleviation of poverty? More specifically is it about the alleviation of today's poor family's circumstances or tomorrow's? Is it about the intervention in housing markets to ensure a steady supply of quality homes for people to live in? Is it about the neighborhoods where people live and the regions in which they work? Is our work about lowering market quality so it becomes more affordable, or intervening in markets that are weak to make them healthy? Much of the language in the Stabilization bill suggest the former, in the face of decades worth of data asserting what's needed is the latter.

Beneath all of this is not the technical problem of the HERA statute needing revision. Or even the CDBG program needing an overhaul. The issue is how we think about our work. What problem(s) are we trying to solve? Have we figured out what to measure?

Until we move beyond the current greatest-in-need bias of the community development system and redesign it completely in favor of how-do-we-obtain-the-most-success (and what does success mean at the local level), we will continue to have problems in our cities and poor rural communities, continue to move billions of dollars into them with little lasting effect, and continue to feed a growing and substantially ineffective community development industry. These are hard and painful questions worth pondering.

Charles Buki is principal of czb, a Virginia-based neighborhood planning firm specializing in deep dive analysis, strategy development, and implementation of revitalization plans.

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Chicago’s Ghost Rails

Just beneath the surface of the modern city lie the remnants of its expansive early 20th-century streetcar system.

Amtrak Cutting Jobs, Funding to High-Speed Rail

The agency plans to cut 10 percent of its workforce and has confirmed it will not fund new high-speed rail projects.

Ohio Forces Data Centers to Prepay for Power

Utilities are calling on states to hold data center operators responsible for new energy demands to prevent leaving consumers on the hook for their bills.

MARTA CEO Steps Down Amid Citizenship Concerns

MARTA’s board announced Thursday that its chief, who is from Canada, is resigning due to questions about his immigration status.

Silicon Valley ‘Bike Superhighway’ Awarded $14M State Grant

A Caltrans grant brings the 10-mile Central Bikeway project connecting Santa Clara and East San Jose closer to fruition.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Caltrans

City of Fort Worth

Mpact (founded as Rail~Volution)

City of Camden Redevelopment Agency

City of Astoria

City of Portland

City of Laramie