The estate tax reduction, plus increasing the retirement income tax exemption, would be traded for an unspecified hike in the gas tax to keep the Transportation Trust Fund solvent. But the $400 million in tax cuts won't satisfy Gov. Chris Christie.

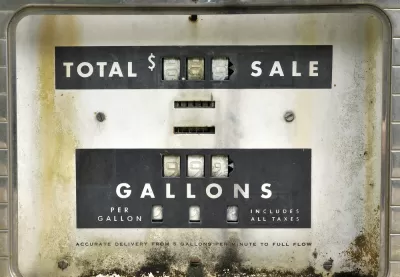

The Garden State's 14.5-cent gas tax (10.5 cent excise tax plus 4.0 cpg Petroleum Products Gross Receipts Tax) is the second lowest in the United States (after Alaska's), having not been raised since 1988, notwithstanding recent attempts to do so.

State Assembly Speaker Vincent Prieto (D-Hudson) crafted the latest 'tax tradeoff' strategy in response to proposals by Gov. Chris Christie that would eliminate the estate tax and raise the retirement income exemption. Christie has previously stated he would only support legislation to raise the gas tax if it was accompanied by tax reductions elsewhere. The tax issue has also prompted a debate about what is considered "tax fairness."

"Prieto said at a Statehouse news conference that he would 'be open' to phasing out or raising the exemption on the estate tax, but only as part of a deal on funding the Transportation Trust Fund, which runs out of money this summer and is largely funded by the gas tax," writes Samantha Marcus of NJ Advance Media for NJ.com.

According to an op-ed published Thursday in NJ.com, "The Transportation Trust Fund (TTF) is $16 billion in debt," write construction industry leaders Robert Briant Jr. and Jack Kocsis Jr.

The solution seems clear: If we can't borrow any more money, we need to increase revenue. Currently, the only solution that can raise enough money to fund the TTF, fix our roads, and begin chipping away at our debt burden is one that includes an increase to the gas tax.

Stay tuned...

FULL STORY: Prieto: No N.J. estate tax cut without transportation funding fix

Trump Administration Could Effectively End Housing Voucher Program

Federal officials are eyeing major cuts to the Section 8 program that helps millions of low-income households pay rent.

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

Ken Jennings Launches Transit Web Series

The Jeopardy champ wants you to ride public transit.

Driving Equity and Clean Air: California Invests in Greener School Transportation

California has awarded $500 million to fund 1,000 zero-emission school buses and chargers for educational agencies as part of its effort to reduce pollution, improve student health, and accelerate the transition to clean transportation.

Congress Moves to End Reconnecting Communities and Related Grants

The House Transportation and Infrastructure Committee moved to rescind funding for the Neighborhood Equity and Access program, which funds highway removals, freeway caps, transit projects, pedestrian infrastructure, and more.

From Throughway to Public Space: Taking Back the American Street

How the Covid-19 pandemic taught us new ways to reclaim city streets from cars.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

Ada County Highway District

Institute for Housing and Urban Development Studies (IHS)

City of Grandview

Harvard GSD Executive Education

Toledo-Lucas County Plan Commissions

Salt Lake City

NYU Wagner Graduate School of Public Service