Richard Blackwell examines the foundations of Canada's housing "affordability crisis," in which prices have doubled over the last decade due to low rates and easy mortgage terms.

"For just the second time in the past century, the country's housing market is pushing the limits of affordability, according to key statistical measures, shutting many potential buyers out of the market, and making it harder for those who have already taken the plunge to pay off their mortgages," says Blackwell. The price of homes in Canada has risen nearly 127 percent since 2000, and 50 percent in just the last six years. Worse yet, the anticipated rise in interest rates later this decade could make housing even less affordable because even a small increase will add hundreds of dollars to existing monthly payments. House prices have slowed in some markets, but Canadians worry that a cooling housing market could hurt the already weak economy.

With the average home costing around $350,000 (nearly five times the average household income), many Canadians are having difficulty finding affordable options in the housing market. "The underlying reason for this," points out Paul Kershaw, a professor at the University of British Columbia, "is that housing prices have risen dramatically, while household incomes - adjusted for inflation - have barely moved at all since the mid-1970s."

Buying a house is becoming increasingly out of reach, especially for young people under financial stress. The generally accepted idea is that housing costs should make up one-third of the household budget, but the current number reflects a worrying trend. “Having young Canadians jump into home ownership, with mortgages that are at income multiples we’ve never seen before, is exposing a broad section of the population to significant risk if we run into any sort of a recession or macro shock or interest-rate rise," said Ben Rabidoux, an analyst with Mark Hanson Advisors. "We are just staggeringly comfortable with debt here in Canada right now."

As Blackwell explains, many have accepted that they will be "house poor" in the long run and are willing to pile on debt as a result of a relatively strong economy and low interest rates. However, the country's housing bubble is a growing concern, especially considering the impact that a recent housing bust has had on their neighbors to the south.

FULL STORY: Frozen out: Behind Canada's housing 'affordability crisis'

Planetizen Federal Action Tracker

A weekly monitor of how Trump’s orders and actions are impacting planners and planning in America.

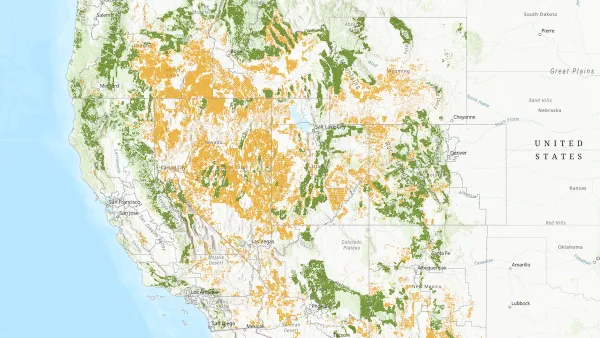

Map: Where Senate Republicans Want to Sell Your Public Lands

For public land advocates, the Senate Republicans’ proposal to sell millions of acres of public land in the West is “the biggest fight of their careers.”

Restaurant Patios Were a Pandemic Win — Why Were They so Hard to Keep?

Social distancing requirements and changes in travel patterns prompted cities to pilot new uses for street and sidewalk space. Then it got complicated.

Platform Pilsner: Vancouver Transit Agency Releases... a Beer?

TransLink will receive a portion of every sale of the four-pack.

Toronto Weighs Cheaper Transit, Parking Hikes for Major Events

Special event rates would take effect during large festivals, sports games and concerts to ‘discourage driving, manage congestion and free up space for transit.”

Berlin to Consider Car-Free Zone Larger Than Manhattan

The area bound by the 22-mile Ringbahn would still allow 12 uses of a private automobile per year per person, and several other exemptions.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

Heyer Gruel & Associates PA

JM Goldson LLC

Custer County Colorado

City of Camden Redevelopment Agency

City of Astoria

Transportation Research & Education Center (TREC) at Portland State University

Camden Redevelopment Agency

City of Claremont

Municipality of Princeton (NJ)