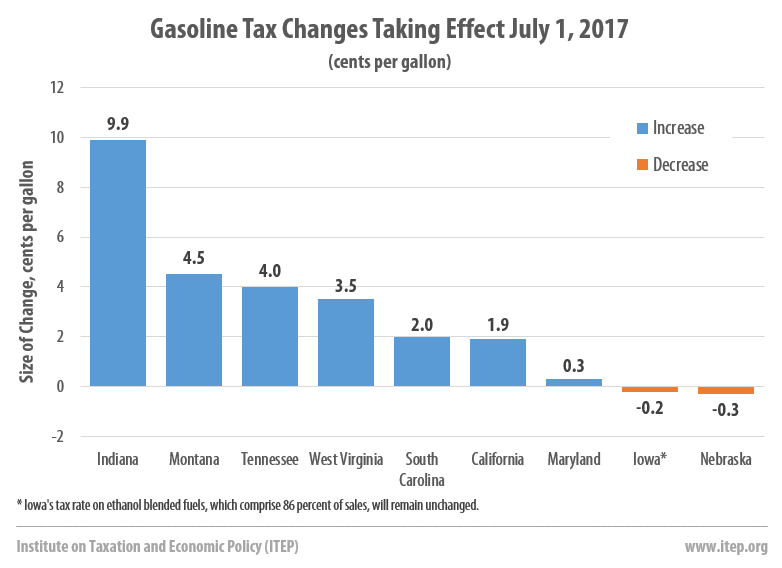

Two new reports on transportation funding issued in advance of the July 4th weekend focus attention on gas prices and vehicle travel. Seven states will increase gas taxes on July 1 according to the Institute on Taxation and Economic Policy.

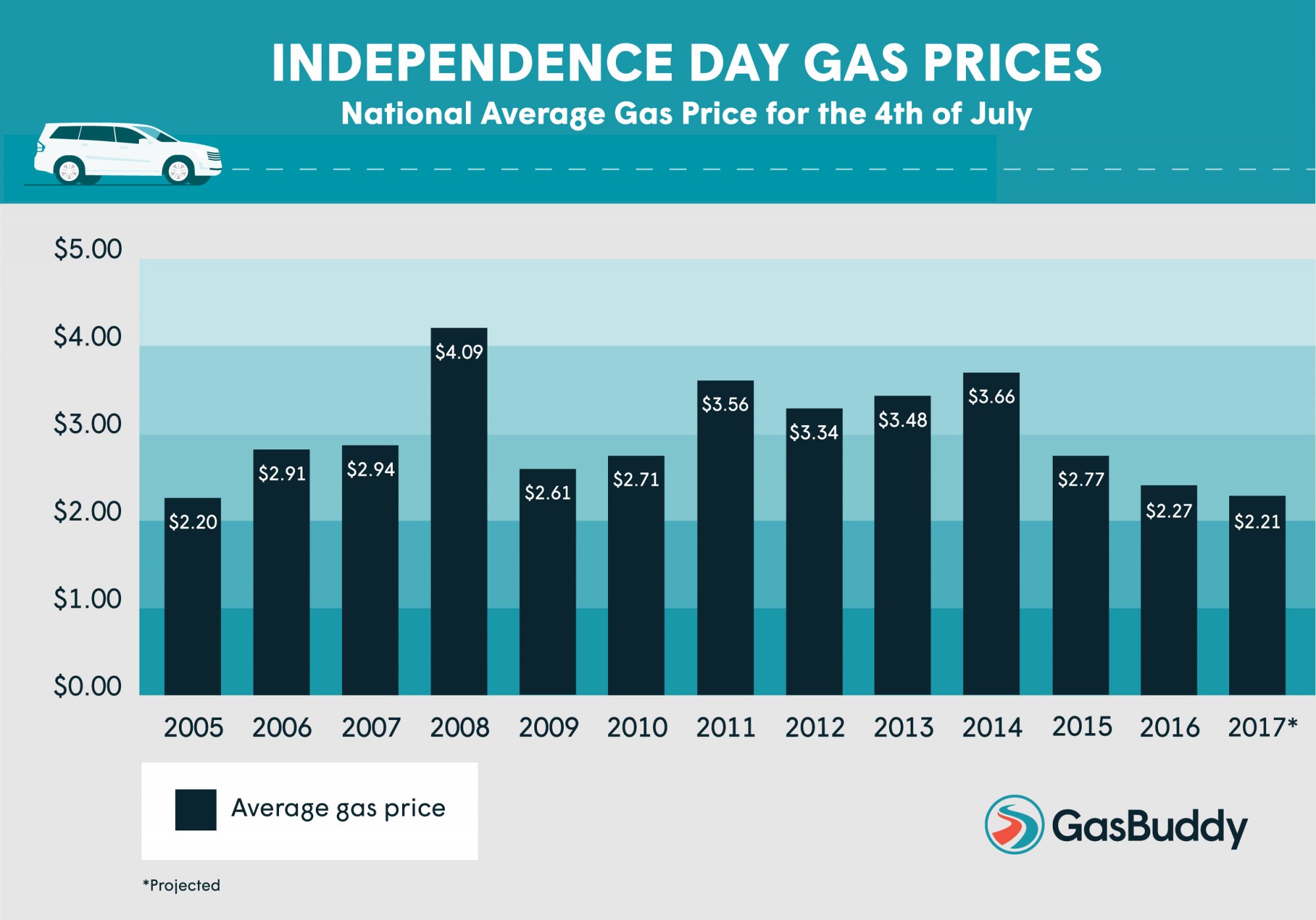

The national average gasoline price for the holiday weekend is projected to be $2.21 gallon, the lowest since 2005, according to Gas Buddy, and the first time lower than on New Year's Day.

"With 1.25 million more travelers than last year, 2017 will be marked as the most traveled Independence Day holiday weekend ever," reports the AAA. "37.5 million Americans will drive to their destinations, an increase of 2.9 percent over last year." The projection should not come as a surprise as the Federal Highway Administration issued a report in April showing that Americans set another record for vehicle miles traveled.

Low gas prices are an ideal time to hike gas taxes, and seven states will do just that on July 1, mostly due to legislatures who had the ability to overcome significant political challenges.

- Indiana will see the largest increase of 9.9 cents per gallon while California and Maryland will adjust gas taxes upwards by 1.9 cents and 0.3 cents per gallon, respectively.

- South Carolina will implement the first two cents of a 12 cents per gallon increase that Republican Gov. Henry McMaster had vetoed, but was overridden by the Republican-controlled General Assembly.

The Institute on Taxation and Economic Policy (ITEP) describes the details behind all the state gas tax changes that take effect July 1 in the first of three reports.

Click here for diesel tax changes on July 1.

ITEP updated two policy briefs as well on June 28:

- How Long Has It Been Since Your State Raised Its Gas Tax?

- Thirteen states have gone two decades or more without a gas tax increase.

- Most Americans Live in States with Variable-Rate Gas Taxes: "Thirty states and the federal government levy fixed-rate gas taxes where the tax rate does not change even when the cost of infrastructure materials rises or when drivers transition toward more fuel-efficient vehicles and pay less in gas tax."

Switch to Vehicle Miles Traveled Fee

Finally, Dug Begley, transportation writer for the Houston Chronicle, reports on new research published in the Journal of Public Economics [pdf] concluding that a "federal tax on vehicle miles traveled [VMT], as opposed to a per-gallon tax on gasoline, could raise money for the Highway Trust Fund and improve society, to the tune of a 20 percent increase in social welfare."

The report indicates that a VMT fee would correct the funding problem created by the policy inconsistency of a stagnant federal gas tax, unchanged since 1993, and steadily increasing fuel economy standards, currently set at 54.5 mpg by 2025, though President Trump is trying to roll it back.

The researchers, Brookings Institution’s Clifford Winston, the University of Arizona’s Ashley Langer, and the University of Houston’s Vikram Maheshri, write (in a message tailor-made for the record travel expected this holiday weekend):

A VMT tax has the potential to generate a more stable stream of revenues than a gasoline tax because motorists cannot reduce their tax burden by driving more fuel efficient vehicles.

Hat tips to Carl Davis and Jenice Robinson, ITEP.

FULL STORY: Gas Taxes Will Rise in 7 States to Fund Transportation Improvements

Pennsylvania Mall Conversion Bill Passes House

If passed, the bill would promote the adaptive reuse of defunct commercial buildings.

World's Largest Wildlife Overpass In the Works in Los Angeles County

Caltrans will soon close half of the 101 Freeway in order to continue construction of the Wallis Annenberg Wildlife Crossing near Agoura Hills in Los Angeles County.

U.S. Supreme Court: California's Impact Fees May Violate Takings Clause

A California property owner took El Dorado County to state court after paying a traffic impact fee he felt was exorbitant. He lost in trial court, appellate court, and the California Supreme Court denied review. Then the U.S. Supreme Court acted.

AI Traffic Management Comes to Dallas-Fort Worth

Several Texas cities are using an AI-powered platform called NoTraffic to help manage traffic signals to increase safety and improve traffic flow.

Podcast: Addressing the Root Causes of Transit Violence

Deploying transit police is a short-term fix. How can transit agencies build sustainable safety efforts?

Minneapolis as a Model for Housing Affordability

Through a combination of policies, the city has managed to limit the severity of the nationwide housing crisis.

City of Costa Mesa

Licking County

Barrett Planning Group LLC

HUD's Office of Policy Development and Research

Mpact Transit + Community

HUD's Office of Policy Development and Research

Tufts University, Department of Urban and Environmental Policy & Planning

City of Universal City TX

ULI Northwest Arkansas

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.