EV fees

Oregon Supreme Court Rejects Challenge by AAA to Stop Electric Vehicle Rebates

A controversial new sales tax on motor vehicles in a state with no sales taxes survived a court challenge. As a result, Oregon consumers will have another reason to consider purchasing or leasing an electric vehicle: receiving up to a $5,000 rebate.

Federal Gas Tax Legislation Would Also Tax Bikes, EVs, and Transit

Rep. Bill Shuster, who chairs the House Transportation and Infrastructure Committee, wants to hike gas and diesel taxes by 15 and 20 cents per gallon, respectively, add two new user fees on bicycles and electric vehicles, and test VMT fees.

Electric Vehicles to Lose Important Perk in Southern California

One of the major reasons for purchasing an electric vehicle in California is the ability to use a carpool lane as a solo driver and use an express lane toll-free. The latter perk will soon disappear for solo-occupant EVs on two freeways.

A Progressive Gas Tax?

One of the criticisms of gas taxes is that it is regressive, i.e., everyone pays the same per-gallon price. A Mississippi legislator has a solution: Eliminate the income tax on the lowest income bracket in exchange for hiking the gas tax 12-cents.

New Hampshire Bills Target Vehicles That Don't Guzzle Enough Fuel

Two bills target hybrid and electric vehicles and even fuel efficient vehicles with new registration fees to increase road funding, as nine states did last year. However, many of those states also hiked gas taxes in the same legislation.

California to Explore Next Steps in Converting From Gas Tax to Road Charge

A summary report of California's 9-month pilot program to test the use of a mileage charge to replace the gas tax to fund road infrastructure has been released. Next steps include exploring available technology to implement the road charge.

Electric Vehicle Sales Would Take a Hit With GOP's Tax Cut

The House GOP tax plan, which Trump wanted to name the "Cut, Cut, Cut" bill, was intended to cut taxes, but it's also cutting credits, like the federal $7,500 electric vehicle tax credit. How much would its elimination affect EV sales?

Budget Gap Spotlights Oklahoma's Onerous Three-Fourths Supermajority Requirement

California legislators have it easy compared to their counterparts in Oklahoma and Arkansas who seek to increase revenue through tax increases. A bill to hike gasoline and cigarette taxes and revise alcohol taxes faces a high hurdle.

Oregon Legislature Passes Gas Tax, Includes Bike Tax

After Gov. Kate Brown signs the comprehensive funding package, Oregon will be the eighth state this year to approve legislation to increase its gas tax and the first ever to add a bike tax to fund bike and pedestrian infrastructure.

Oregon's $3 Billion Transportation Funding Legislation Has a Tax for Almost Everyone

The package, which doesn't tax walking and running shoes, went to the legislature on June 30. It includes a ten cents per gallon gas tax, a 0.10 percent payroll tax, a $15 tax on new bikes costing at least $200, and a potential toll on I–205.

West Virginia Becomes the Seventh State to Hike Gas Taxes, But Not by Much

Democratic Gov. Jim Justice signed legislation to increase its 32.2 cent state gas tax by about 3.5 cents per gallon and add substantial hybrid and EV fees. He also signed legislation to increase and expand road and bridge tolling.

Odd Years are Good for Hiking State Gas Taxes

Already California, Indiana, Montana, South Carolina (overriding a governor's veto), Tennessee, and Utah* have raised gas taxes this year, while last year was a drought—only New Jersey increased its gas tax.

Gas Taxes Advance in New Mexico and Wisconsin in May

The Democratic-controlled New Mexico legislature passed a 5-cents per gallon fuel tax increase and the Republican-controlled Assembly in Wisconsin backed a plan to apply sales tax to fuel, but their Republican governors oppose any tax hikes.

Indiana Legislature Passes 10-Cents Fuel Tax Hike on Final Day of Session

Just past midnight on Saturday morning, the Indiana State Senate passed the transportation plan after the Housed approved it Friday. It also passed a $32 billion, two-year state budget bill, then adjourned for the year, one week ahead of schedule.

Tennessee Governor Poised to Raise Gas Tax by Six Cents per Gallon

Both chambers of Tennessee's General Assembly approved Gov. Bill Haslam's transportation plan on April 19, which hikes diesel taxes by 10 cents per gallon but lowers other taxes. Indiana appears poised to follow with a 10-cent gas tax increase.

California's Record Fuel Taxes Hike Passes Legislature in One Day

On April 6, the Senate and Assembly passed a comprehensive transportation funding package that it had been unable to do for years, thanks to much deal-making by Gov. Jerry Brown. The gas tax will increase by 12 cents per gallon on November 1.

Gov. Jerry Brown and State Democratic Leaders Agree on Gas Tax Deal

Revised transportation funding legislation is needed to meet California's ballooning infrastructure deficit, but it needs a supermajority to pass, and it contains a fatal flaw for clean air activists.

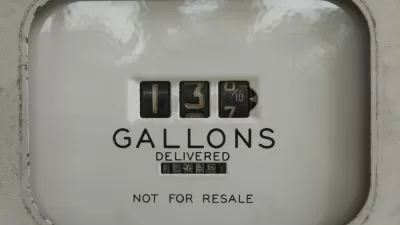

Electric Vehicle Fees: Where's the Controversy?

Some may find it silly to get worked up over an annual fee of about $100 to pay for road maintenance when electric vehicle purchasers receive a $7,500 federal tax credit, on top of generous state perks, but electric vehicle supporters object to them.

Legislation to Toll Indiana Interstates and Hike Gas Tax Introduced

Tolls on interstate highways are being pushed in Indiana as a means to increase road funding, no easy task even if a waiver is given. The bill would also increase the gas tax and charge electric vehicle owners a fee for road maintenance.

New Year's Day State Gas Tax Increases, Decreases, and What Lies Ahead

Pennsylvania, the state that had the highest gas tax last year, saw the highest gas tax increase of 7.9 cents per gallon, the final increment of a 2013 law. Michigan's 7.3 cents tax increase, signed into law in 2015, is the second largest increase.

Pagination

City of Costa Mesa

Licking County

Barrett Planning Group LLC

HUD's Office of Policy Development and Research

Mpact Transit + Community

HUD's Office of Policy Development and Research

City of Universal City TX

ULI Northwest Arkansas

Town of Zionsville

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.